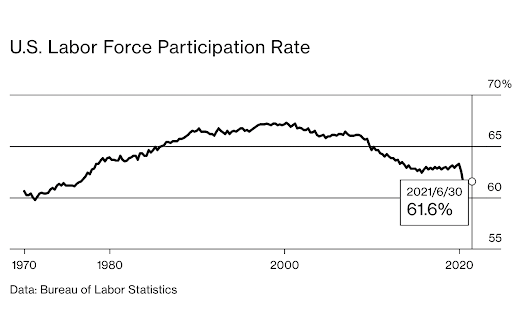

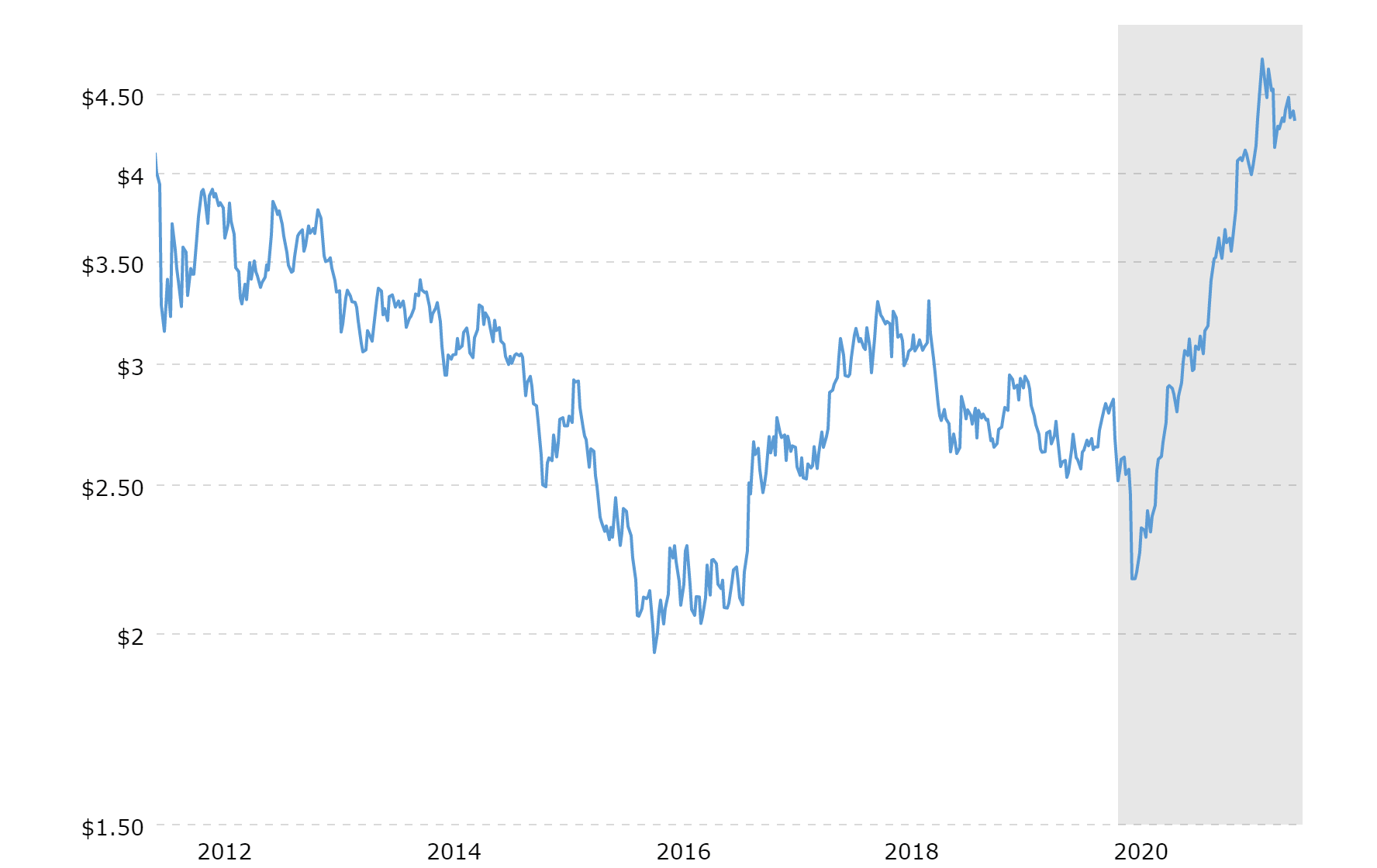

| As you might expect, copper does in fact have a broad range of uses throughout the world, and therefore the economy. The world consumes about 24 million metric tons of the stuff every year, and the US made use of over 3.3 million of those metric tons in 2020. Copper is primarily used in electrical applications, which make up 65% of its consumption, followed by 25% industrial usage, and 10% between transportation and other miscellaneous uses. Does it matter? In general, rising copper prices have indicated strong demand and global economic strength. Historically, the price of copper has been strongly correlated with the price of gold, oil, the Chinese economy and world trade. Base metals like copper are often viewed as a hedge against price inflation and tend to do well as economic activity recovers, just as we saw earlier this year. So, how's the weather? Well, copper prices have been on a strong upward trend since early 2020, reaching near 2011 levels after having tapered off over the last decade. However, prices fell noticeably in July, and with the potential for a copper shortage coming sometime in the near future, some investors are concerned. Copper price chart per pound

Source: Macrotrends.net Quick take. But beyond near-term macro-economic trends and inevitable fluctuations as quarantine measures impact copper mining abilities and country-specific reopening plans (and therefore copper demand), long-term changes such as accelerating cleantech and renewables projects, electric vehicle adoption and the increasing potential for major infrastructure spending in the US may bode well for copper in the long run. |