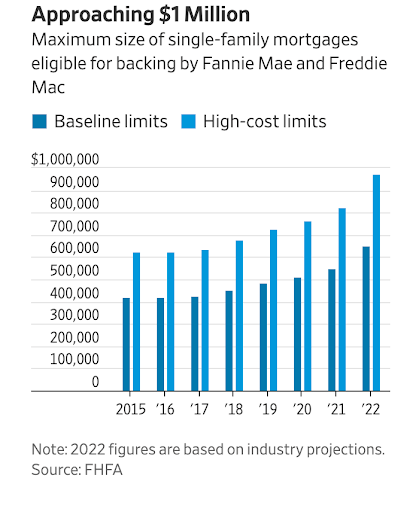

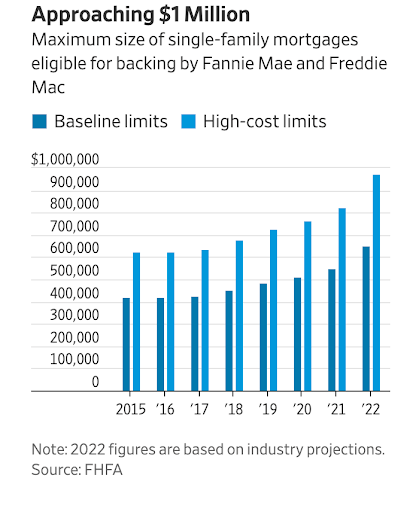

| Did you know that about 50% of US mortgages are backed by a GSE (Government Sponsored Enterprise) of some kind? Whether it be FHA, VA, USDA or plain ole' Fannie Mae or Freddie Mac, there's no doubt that federal backing plays a huge role in the US housing market. In 2022 though, the total value of loans under their supervision could increase noticeably as the cap on mortgage balances is being forced upwards with rising home prices. The logistics Even though it might seem like the government has access to limitless money and can easily jump-start the figurative money printer at any given time, they still have parameters on the size of mortgage these organizations can back. The limit for 2022 now sits at around $647,200 for mortgages in "most" parts of the country, with the flexibility to extend all the way to $970,800 in "higher-cost" markets. Yes, the federal government will now back mortgage loans of nearly $1 million. However, housing prices have been on the rise, subtly nudging the MBS (mortgage-backed securities) market to jump—getting GSEs to ask "how high?"

The new $1 million ceiling These limits are adjusted annually, as one could argue they should be to account for housing price increases. And the following year could bring more of a buoyant spike, as housing prices have been rising at record rates—up 16% at the end of Q3 vs. the prior year to $363,700. These adjustments come at a time when these agencies' market share has been growing substantively too, with Fannie and Freddie now having a hand in over 57% of new mortgages in 2021, compared to 42% in 2019. The bigger picture This increase to the one million dollar mark by these agencies could make it cheaper and easier for some borrowers to buy a home. But with that, some may beg the question, how much of a role should the government be playing in our mortgage industry, and how much is too much to back? 🔎 Take this quiz-based microlesson if you want to zoom in on some mortgage basics: |