| There are many ways of looking at retirement. Some workers love what they do and could never imagine giving it up one day, while others subscribe to the FIRE (financial independence, retire early) movement that encourages saving and investing early enough to retire young and live off of your passive income. In truth, though, whatever philosophy people hold dear to their hearts, their goal is to have the freedom to do what they love every day. And in recent months the watchword has become “flexibility.” To attract and retain the talent they need amidst a tight job market, employers have been adapting their benefits to the need of the hour. The latest offspring of this phenomenon, it appears, has been to allow prospective retirees to step into their golden years early and part-time. Phased out retirement Simply put, a phased-out retirement plan is one that allows workers nearing retirement age to cut back on their hours while keeping some pay and benefits. 🤝 More phased-out retirement plans: In 2016, just 16% of US employers were offering phased out retirement plans while 23% were doing so in 2021. Businesses are also starting to make accommodations for this desire in a more structured way with the percentage offering formal phase-out programs rising from 6% in 2019 to 8% most recently. 👵 More retirees than expected: Companies are being nudged towards more flexibility. In the 22 months spanning February 2020 to November 2021, roughly 2.6 million more employees retire than expected. And that’s just retirees, so mostly baby boomers.

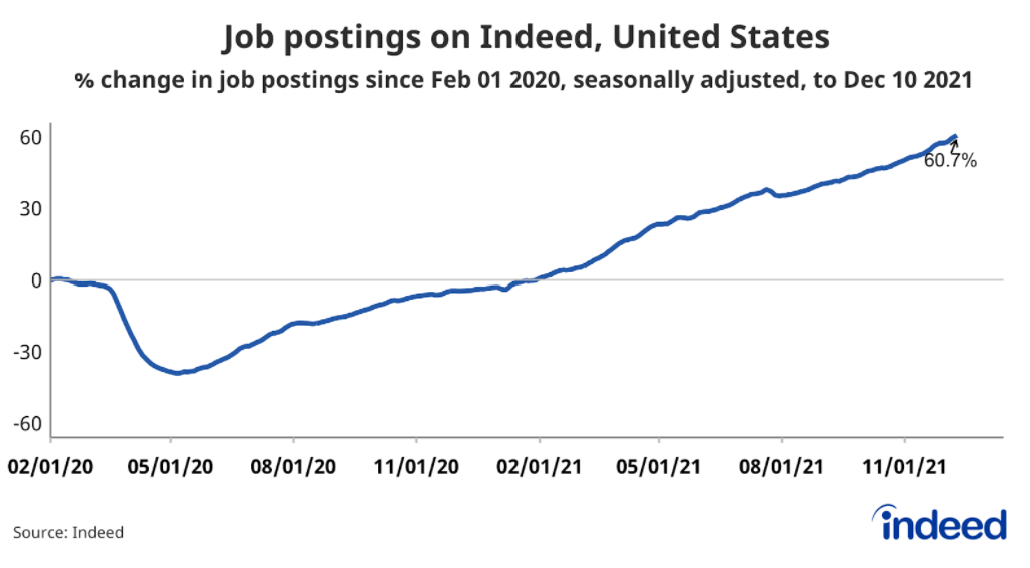

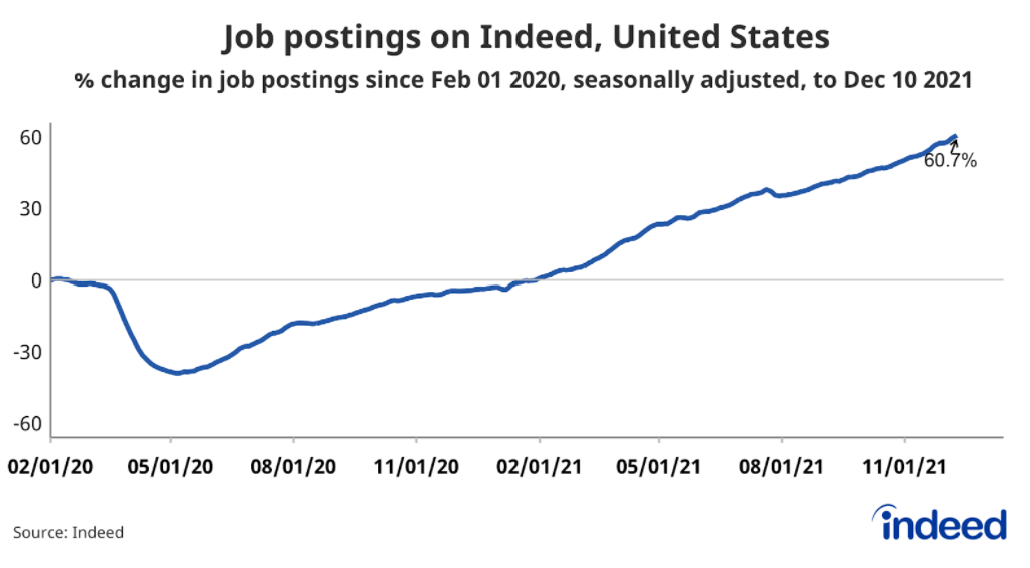

🏃 Younger ones also leaving: This acceleration toward retirement doesn’t even account for “the great resignation,” which saw nearly 68.9 million Americans leave their jobs in 2021, with 69% of them leaving voluntarily. 📈 Empowered workforce amidst an inflationary environment: All of this plays together to give way to the job market we’re seeing now. With more retirees, more resignations, more job openings, and higher wages, an intersection of admirable personal empowerment and a less desirable counterpart, inflation, has arisen.

Planning for a flexible retirement For some people, phased-out retirement is an ideal way to either stay involved in something they enjoy while also winding down, or just remain active and engaged with the working world as they age. That’s not the case for many though, and there are undoubtedly millions in the US being financially coerced into partial retirement simply because they can’t afford to let off the gas just yet, whether due to lack of preparation, or just hard times. With information and optionality you can make the best choices. In an ideal scenario, you’ve set yourself up financially to have a true choice in your retirement, and aren’t forced into any working arrangement you don’t enjoy. ✍️ Here's a related lesson on this topic: |