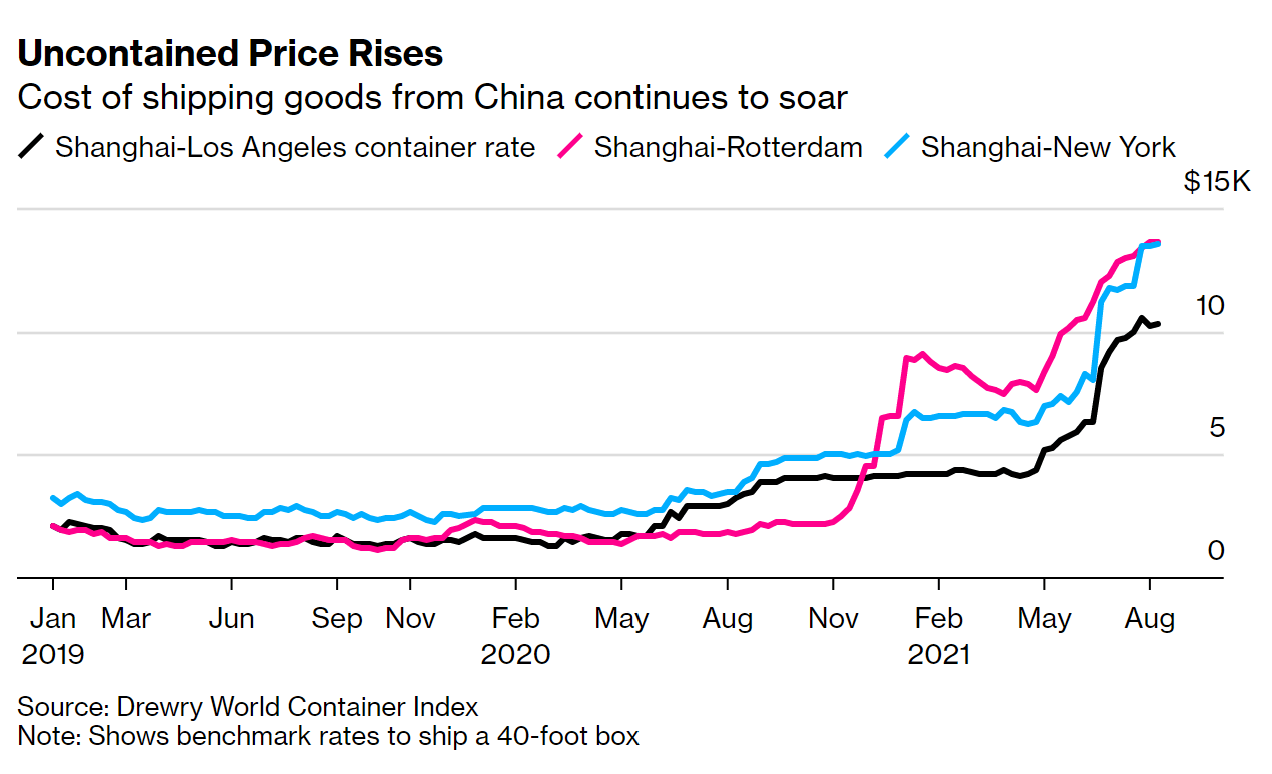

| Even though the global pandemic began over 19 months ago now, we're still experiencing its ripple effects today. The world has fought back and rebounded to an extent, but the aftermath of Covid-19 and its variants has inevitably left us with lingering issues that impact the global economy. Supply lines are one of these things. Although it's probably one of the most boring and monotonous headlines you read last spring, their understated value is becoming realized during pandemic-related bottleneck after bottleneck. The current situation A recent survey by Deloitte showed that 44% of CFOs reported seeing shipping delays cause at least a 5% increase in product pricing, while another 32% reported sales having fallen due to either shortages or delays. A large portion of the supply lines many companies rely on runs through China, and as a result, many of these same CFOs are hoping to transition those supply lines elsewhere. In fact, 32% of those CFOs claimed they'd be working to reduce their reliance on Chinese sourcing, and 39% want to see their sourcing from North America increase as well. Because of sporadic delays, extra lockdowns, shortages, and increasing prices, we're seeing a confluence of events create a sort of damning butterfly effect on supply lines. Shipping costs have increased over 13x from pre-pandemic levels, and container costs are nearing $10,000 in the US.

Source: Bloomberg Zooming out Productivity has rebounded and our attempts to return to normalcy have in turn revealed some true kinks in the supply lines. The pandemic might have been the starting gun, but the shipping race has gotten creative, and the problems it faces are now multifaceted. Resurrecting and restructuring a global supply chain from pandemic lockdowns is not as simple as it seems. This massive piece of infrastructure is no sports car, and now labor concerns—talent recruiting and retention, burnout, morale, rising wages—are top-of-mind internal risks for this quarter. |

No comments:

Post a Comment