TOGETHER WITH  | Good day. Electric vehicle (EV) adoption rates are closely watched around the world. What EV adoption rate by country typically signals mass EV adoption? a. 5%, b. 15%, c. 25%. Follow the wave 🌊 below for the answer. Here are the market & money topics du jour: - Private companies are having a tough time

- How will markets do in the 2nd half of 2022?

- Some financial tips you should probably ignore

| |

INVESTING Private Companies Are Having A Tough Time | | | | The implications of a bear market spread much further than just the publicly listed companies traded on exchanges. Market conditions influence all companies, and oftentimes private ones suffer the most in times like these. What’s happening to private money? - A majestic run: The pandemic panic in 2020 was short-lived to say the least. Recovery was rapid and the emphatic rebound quickly reached private equity. In 2021, venture capital investments doubled from the year prior to $643B, and those funds gave way to 586 new unicorn companies and over 1,000 IPOs in total. Broad market returns were complicit during this boom too, with the S&P 500 rising almost 27% as investing quickly became cool again, and numerous trends abounded.

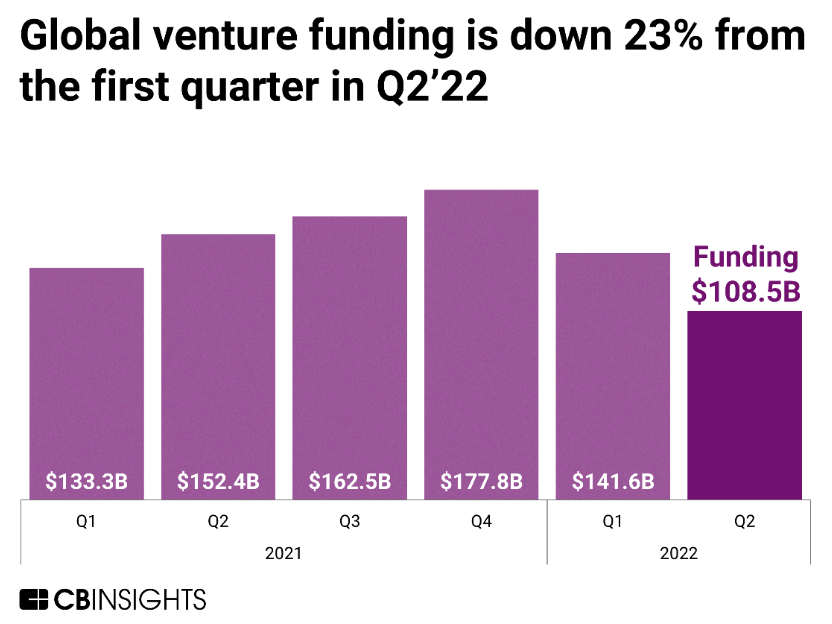

- What goes up, must come down: Global venture funding in Q2 of this year is down 23% versus Q1, and down 29% from Q2 of last year. This marks the second-largest quarterly percentage drop in funding in a decade, according to CB Insights. IPOs are also down in a big way, with only 124 companies going public so far in 2022. That puts us on pace for roughly 250 for the year, a massive downturn from last year’s 1,000+ public debuts.

- Anecdotally: The data paints a big picture, but it’s the details that hit home. Panera Bread canceled their plans to go public via SPAC, buy-now-pay-later (BNPL) platform Klarna’s valuation recently plummet to $6.5B from $45.6B only a year ago, Instacart’s valuation also tumbled 40%, and countless other private businesses are suffering the fallout of this pessimistic market. They all serve to show the reality of the situation we’re in now.

What this means - What’s down in the well comes up in the bucket: It might seem convenient to think of private equity and the public markets as two separate things, and maybe sometimes they are, but they’re also extremely correlated at times. These private companies under the microscope are vying to become public, and often serve as an indicator of attitudes toward traditional markets as well. Both public and private money are suffering right now.

- But, this can also be an opportunity: However aligned that suffering is now, things might not be so synchronous on the way back up. Data shows that the internal rate of return (IRR) on private equity outperforms public markets in the aftermath of recessions. Some analysis done by Fortune shows that the return produced by top-quartile vintages (venture funding debuts) around the 2008 recession produced about a 61% IRR, while the S&P fell 38% that year.

- Going forward: In 1980, there were only about 28 private equity firms in total, yet now we have over 9,000 managing nearly $7T in value. So, despite some turbulence, private equity has become increasingly trendy over the last few decades, and will likely continue its overall upward trajectory in the long run.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it:

| | | |

MARKET OUTLOOK How Will Markets Do In The 2nd Half of 2022? | | | | Unless you were investing strictly into real estate and commodities, the first half of 2022 was likely a pretty painful experience for your portfolio, leaving most of us wondering just how much longer we have to suffer the ramifications of this bear market. Is there any hope for the second half of the year, or are we destined for an outright red campaign in 2022? The case for a positive turn - A much-needed value check: 2020 and 2021 were unprecedented years in terms of government stimulus, economy propping, and subsequently market euphoria resulting in abnormally high returns and trends like meme stocks. The S&P 500 only recently returned to its long-term CAPE ratio, further indicating that valuations and ratios across the board were likely skewed too far north amidst all that buying the last couple years. This return to normalcy, albeit a bit harsh, was arguably a needed one, allowing bullish investors to return to risk-on in the second half of 2022.

- Waning fears and normalization: Just like lofty valuations were a symptom of market sentiment in 2020 and 2021, this downward pressure we’ve seen is also a symptom of a different disease: fear. Not only have investors been timid in the wake of rising rates, but other global phenoms like international conflict and inflation have also left us a bit shy as their uncertainty looms. As higher rates become normal and everyone realizes it’s okay to raise them, conflict cools, and hopefully inflation declines too, there’s a chance that investors will eventually allow themselves to return to some sense of normalcy by Q4.

The case for more negative - Stubborn negative catalysts: In April, we saw headlines about how inflation might actually be peaking, and then in May it rose again. While oil prices have somewhat stagnated, energy costs are still extremely high, and inflation is still finding its way into consumer staples across the board. Internationally, conflict in Ukraine and between NATO nations is still going strong, putting further upward pressure on commodities, which inevitably stokes the flames of fear in investors.

- Fear is stronger than hope: It’s well documented in psychology that the fear of loss is stronger than the allure of gain, and this is manifesting itself in the markets right now. Investor sentiment is at the bottom of the barrel, consumer confidence keeps moving lower, and the Fear & Greed Index is still in red too. Fear is difficult to irradiate, and it’s often a slow process of overcoming it. If these macroeconomic concerns persist, it’ll make an already nervous crowd even harder to reassure, subsequently prolonging this bear market.

| | | |

SPONSORED BY LINQTO An Opportunity To Invest In The World’s Leading Unicorns | | | | Given a pending recession, inflation, and volatility of public equity markets, more investors are clamoring to get into private markets. But not just any private markets. We’re talking about the world’s leading unicorns. 🦄 And we found a company that’s doing just that. Enter Linqto. They offer accredited investors access to: - The world’s top unicorns—private companies with greater than $1 billion in valuation, like Ripple Labs, Uphold, Dapper Labs, WHOOP, and BlockFi.

- Private shares of these companies for a minimum investment of $10,000. While they don’t promise every listing will go public, Linqto does have a fantastic track record, including exits like: Coinbase, Robinhood, SoFi, Marqeta, and Innovium.

And Linqto is compliant in over 100 countries globally and has over $122M in investments on the platform. You can access pre-IPO investments, proprietary research, and even check out shares of Ripple Labs before that SEC lawsuit settles!

| | | |

MONEY TIPS Some Financial Tips You Should Ignore | | | | If you’re searching for tips on how to handle your money, you’ll find no shortage of them anywhere. Whether it’s online or your family (who are, of course, experts) chiming in, financial advice is everywhere, but some of it should be ignored. It’s overwhelming enough to manage all aspects of your financial life, so let’s make it a little easier by filtering out some suggestions that can be ignored. - Avoid debt: Insert recycled Dave Ramsey joke here, and onto the real point. While debt can certainly weigh you down and even wreck your life when it’s mismanaged, it can also help you when leveraged properly. Debt can be a capable tool that, if mastered, will serve you.

- Just trust your advisor: If you have a financial advisor, it makes sense that you should have faith in them, but only to a certain extent. Even if you trust your advisor, you should still take the time to educate yourself on what’s being done with your money (ahem… Finny anyone?), therefore making you qualified to sign off on all the moves they're making.

- You have time for retirement: In an ideal world, investing and saving for retirement should begin as soon as you have an income. The power of compounding interest is real, and will make a huge difference to your ending balance the earlier you start. Don’t wait until you’re 30 to start thinking about life after work.

- Carry a balance to help your credit score: There’s a longstanding myth in the credit world that carrying a revolving balance can somehow improve your score, and it’s been proven false. The right move here is to pay off your balance in full every statement cycle, and if not then, as soon as possible.

- Credit cards are a gateway drug to debt: While there are certainly unfortunate situations where consumers get themselves into trouble with credit cards, you don’t have to be one of those situations. Credit cards can be a great asset when used properly, and allow you to take advantage of things like cash back, travel insurance, welcome bonuses, and more. Just… don’t spend money you weren’t already going to spend.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it:

| | | |

🔥 TODAY'S MOVERS & SHAKERS | - Canoo (+79.8%), a US EV maker, struck a deal to sell at least 4,500 (up to 10,000) delivery vans to Walmart (+0.7%) for an undisclosed amount.

- Twitter (+3%) shares are trading higher today following Elon’s attempt to terminate his $44 billion takeover of the social media company; the company will fight Elon’s allegations that it breached its obligations.

- American Airlines (+10.5%), Delta (+6.7%), United Airlines (+7.5%) on perhaps optimism given that airline stocks have been beaten up; Delta reports their most recent quarterly earnings before the open tomorrow.

- Bitcoin (-0.4%) to $19,868.80 (1D)

- Ethereum (-2.1%) to $1,072.36 (1D)

This commentary is as of 8:15 am PDT. | | | |

🌊 BY THE WAY | - 🔌 Answer: Once 5% of new-car sales go fully electric, everything changes — according to a Bloomberg analysis of the 19 countries that have made the EV pivot (Bloomberg)

- 🦾 Harvard developed AI identifies the shortest path to human happiness (SciTechDaily)

- 👀 ICYMI. Are we seeing recession warning signs? (Finny)

- 📉 Finny lesson of the day. A majority of economists think the US economy will shrink, leading to a recession. Take this 6-minute micro lesson on the topic if you haven't already:

| | | |

What did you think of Finny's The Gist today? (Click to vote) | | | |

| Finny is a financial education platform on a mission to make your money work for you. We offer a customized financial learning platform through bite-size, jargon-free lessons, money trends & insights. The Gist is Finny's twice-a-week (Tues & Thurs) newsletter covering personal finance & investing insights and money trends. Finny does not offer investment and stock advice or endorsements. The Gist content team: Austin Payne, Chihee Kim. We're thankful for the support of today's sponsors and partners—Linqto & Tally—as they make rewards on our platform possible. If you're interested in sponsoring The Gist, please reach out to us. And if you have any feedback for us, please contact us. | | | | | | | |

No comments:

Post a Comment