TOGETHER WITH  | Good day, it's Giving Tuesday. Can you guess how much people in the US donated on #GivingTuesday in 2021? a. $270 million, b. $1.2 billion, c. $2.7 billion. Follow the wave 🌊 below for the answer. Today's money topics: - Electric vehicles are going mainstream

- The pitfalls of loss aversion

- Don't forget to use your FSA

| |

MARKET OUTLOOK Electric Vehicles Are Going Mainstream | | | | Fossil fuels have been set on a collision course with renewable green energy sources for decades now, and the outcome seems almost fixed — the shift toward green energy is unavoidable. But there's one aspect of the economy that's recently risen to the forefront of this duel: electric cars. It's no longer Ford vs. Chevy. It's now gas vs. electric, and it looks like the underdog might soon be on top. EVs rise to prominence - Walk to run: EV sales growth has been very slow prior to the last couple of years, but began to tick up in 2020 and 2021 as recent data shows EVs accounting for 3.6% of overall vehicle sales. And most projections have EVs taking up over 50% of new car sales by 2030.

- Overall growth: The global EV market was valued at $178.5B in 2021, but it's projected to top $1.1T by 2030 with a 22.5% compound annual growth rate (CAGR). The market for alternative fuel vehicles is growing too and is expected to reach over $1T in value by 2030. All of this growth chips away at the market share traditional vehicles used to hold.

- New regulations: Perhaps the most powerful of catalysts is the looming regulation around gas-powered cars. The US plans to stop all gas car sales by 2035, and plenty of other states plan to implement their own bans as well. Elsewhere, Norway, South Korea, and others plan to start as soon as 2025, and tens of other nations are also in line to place similar bans in the years to follow.

- Newcomers: Although Tesla was an early mover, the EV market has been welcoming several new viable competitors to the market in recent years. Aside from specialty manufacturers, even the traditional giants have stopped resisting and begun rolling out their EV models. With growing acceptance, more manufacturing bandwidth, and a healthy dose of competition, an EV future seems inevitable.

- The big picture: Simply put, it's expansion and growth for the EV industry. But there's also the changing of the guard from the old to new will test automotive giants' ability to transition. There's also the obvious bleed-over growth that will find its way into relevant partner industries, like battery producers, utility providers, delivery and logistics, even R&D and core commodities like copper.

| | | |

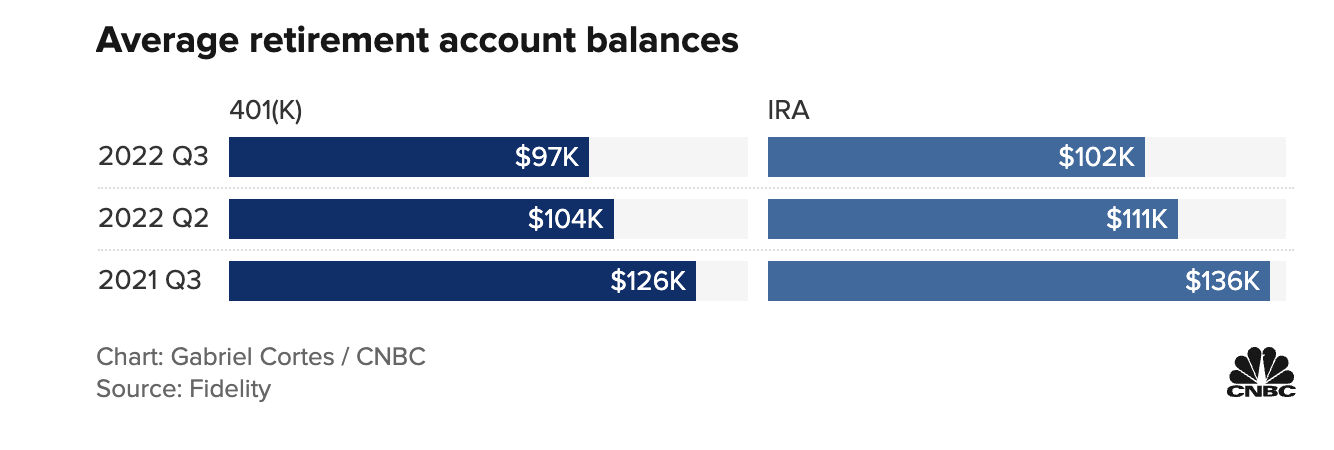

INVESTING The Pitfalls of Loss Aversion | | | | If the stock market was the weather, 2022 has been a storm, and it's hard to blame anyone for trying to seek some shelter from the elements. It's a rational thing to do, after all. We have to protect ourselves and our investments from the threats that linger — or do we? While it might seem logical to search for stability during a volatile bear market like this, what if our precautionary actions are actually detrimental to our portfolio? Data says these precautionary actions might be a bad idea. No choice is a choice - A rough year: Investors' tendency toward safety lately no doubt stems from a down and choppy market. Indexes like the S&P 500 are down 17% year-to-date, but that doesn't quite paint the picture. A more sobering reality is the fact that average 401(k) balances are down 23% over the last year, and IRAs are down similarly — representing thousands in losses.

- Recent moves: 18 of 21 (85%) trading days in October saw investors favoring fixed-income investments, up from an already high 73% of trading days so far in 2022. Stable value and money market funds made up 81% and 16%, respectively, of net investor inflows during the month.

- Temporary relief: The pain of losing $100 is often greater than the joy of gaining it, right? While safe moves like this may bring comfort in the short term, they can shave off thousands in portfolio growth over the long run. Prioritizing loss aversion over consistency and "toughing it out" is a primary contributor to individual investors underperforming the markets. Heck, just ask Bob.

- Changing course: Making a change to your long-term portfolio to adjust for market conditions is often much like traffic. By the time we find an alternate route and take it, we would've been farther ahead had we just bitten the bullet and stayed the course.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

FEATURING CHARITYVEST | | | | Starting a DAF with Charityvest means that you can be both tax smart and purposeful about your lifelong giving journey. There are no minimums to open an account and low fee investing options so your giving balance can grow over time. Open your DAF today! | | | |

WORK BENEFITS Don't Forget Your FSA | | | | Not to be confused with the HSA, the FSA (flexible spending account) was created back in 1978 by Congress in an effort to give employees more options and flexibility when it came to covering their medical expenses. An FSA allows an employee to contribute pre-tax dollars, up to $2,850, to cover their qualified medical or dependent care expenses for the year. What to know about FSAs - An overview: FSAs come in a few different flavors. First, we have the traditional healthcare FSA (HCFSA), which is intended for a broad range of healthcare expenses. Next, there's the limited expense HCFSA (LEX HCFSA) for health savings account (HSA) holders, which can be used only for dental and vision care expenses. And lastly, the dependent care FSA can help working parents pay for childcare-related expenses while getting a tax break for it.

- The basics: FSAs allow employees to contribute pre-tax dollars up to their contribution limits to cover their qualified medical or dependent care expenses for a given year. 2023 limits are $3,050 for the Health care FSA (HCFSA) and the Limited Expense HCFSA (LEX HCFSA) and $2,500 for a dependent care FSA. Contributions are deducted from your salary pre-tax and in most cases, you'll need to keep your receipts to get reimbursed.

- Use it or lose it: FSAs are flexible, supplemental savings accounts, but they do have their limitations. Any funds that are left unused will be returned to your employer at the end of the year. Because of this, employees reportedly forfeit upwards of $1B annually in unused funds even with 36% of companies allowing a grace period.

- Eligible expenses: FSAs can be utilized primarily for medical-related expenses like OTC products, dental, vision, and other qualified needs. The list of included expenses is now longer than ever, but account holders can also choose to spend FSA money on often overlooked medical purchases too — even simple things like covid tests, hand sanitizer, masks, and more.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

🔥 TODAY'S MOVERS & SHAKERS | - Bilibili (+22.8%) as the China-based video-sharing website reported better-than-expected financial figures in this latest quarter. Daily and monthly active users increased by 25% from last year.

- Hong Kong and Shanghai markets rallied with the Chinese government reporting a decline in Covid infections within mainland China. US-listed China-based companies are rallying around that sentiment: RLX Technology (+13.4%), Lufax Holding (+12.1%), and Zai Lab (+11.2%).

- Apple (-1.6%) after a stock price drop of 2.6% yesterday following reports that unrest at China's Foxconn iPhone factory could result in a shortfall of 6 million iPhone Pros produced.

- S&P 500 Index (-0.5%) to $3,943.18 (1D)

- Bitcoin (+1%) to $16,375.50 (1D)

- Ethereum (+3.2%) to $1,208.34 (1D)

This commentary is as of 8:45 am PDT. | | | |

🌊 BY THE WAY | - 🎁 Answer: In 2021, Giving Tuesday raised $2.7 billion in total donations in the United States. This amount was 9% more than the previous year (Investopedia)

- 💸 Consumers lay out $1,600 yearly for health-care products that FSAs (flexible spending accounts) could have covered (CNBC)

- ❤️ ICYMI. Do good & get a tax break — donor-advised funds (Finny)

- 💼 100 UK companies sign up for four-day week with no loss of pay (The Guardian)

- 🔋 The price of your Tesla Model Y varies by more than $60,000 depending on where you are in the world (Bloomberg)

- 💵 Finny lesson of the day: It's always good practice to take a peek at your work pay stub every now and then to ensure that you're withholding the right amount from your pay:

| | | |

| |

| Finny is a financial wellness platform on a mission to make your money work for you. The Gist is Finny's twice-a-week (Tues & Thurs) newsletter covering personal finance & investing insights and money trends. The content team: Austin Payne, Carla Olson, Chihee Kim. Finny does not offer investment and stock advice. Please support our brand sponsor—Charityvest—as they make rewards on our platform possible. If you're interested in sponsoring The Gist, please reach out to us. And if you have any feedback for us, please contact us. | | | | | | | |

No comments:

Post a Comment