| |||||||

| |||||||

| |||||||

| | |||||||

| |||||||

| |||||||

| |||||||

Tuesday, October 31, 2023

📈 Should you consider emerging markets?

Monday, October 30, 2023

🤯 All GPT-4 Tools At Once, A New Upgrade.

🤯 All GPT-4 Tools At Once, A New Upgrade.Plus: Biden's Sweeping AI Order & The AI Wearable Race.

Presented by: UiZard - Design Made Easy. Greetings Team 🙏, GPT-4 has just unveiled an incredible upgrade, bringing a new level of convenience to your conversations. In this edition, we delve into the details of this remarkable development. Additionally, we decode President Biden's AI order and keep you updated on the exciting AI wearable race. Let’s go in.

"Artificial intelligence is the electricity of our future." - Fei-Fei Li 💪🏽 Important AI News and Trends.

🌐 Web3 and Other Tech news.

Biden's Sweeping AI Order Attempts to Ensure National Security.President Biden has issued a comprehensive order to address AI threats to national security. Companies developing such AI models must share their safety measures. This order covers a wide range of AI challenges, including national security, competition, and privacy. It mobilizes government agencies like commerce, energy, and homeland security. The goal is to establish robust AI safety, security, and trust measures. The order empowers the White House to use the Defense Production Act to oversee AI models with significant risks. It also addresses privacy concerns and competition issues. However, full implementation remains uncertain, and bipartisan legislation may be needed to further advance AI governance. This comes as global discussions about AI regulation are ongoing. VP Kamala Harris will discuss US policy on AI, and the EU is already drafting tough AI regulations. World leaders will gather in Britain on Wednesday for a meeting on AI safety organized by Prime Minister Rishi Sunak and the G-7 nations also agreed on an AI “code of conduct” this week, aiming “to promote safe, secure, and trustworthy AI worldwide.” Design Made EasyAre you looking for an easy way to create beautiful designs?

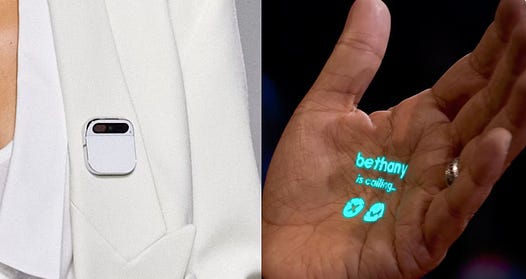

Use the Autodesigner widget to generate individual screens with text prompts, use text, images, or links to craft new themes, and more. Collaboration is key. You can share projects with stakeholders, Import files from other tools, export screens or components in SVG, and select Handoff Mode to get the CSS code. Going from idea to mockup, to clickable prototype has never been so easy. All GPT-4 Tools At OnceOpenAI is set to launch an updated version of ChatGPT, introducing a multimodal GPT-4 variant that grants users access to all GPT-4 tools seamlessly, eliminating the need for constant switching. This enhancement includes advanced data analysis, the innovative DALL·E 3, and integrated browsing capabilities. Notably, the "All Tools" feature offers an array of GPT-4 functionalities, marking a significant stride in generative AI, as it extends beyond text-based queries. Users can now upload images and prompt DALL·E 3 for responses, broadening the scope of their workflow. Furthermore, there is anticipation surrounding OpenAI's upcoming DevDay conference, where new tools and developments are expected to be unveiled. The Race for AI Wearables is Here, Pin AI's Debut Looms.Humane is launching "Pin AI," an innovative AI wearable on November 9th. Designed by Apple veterans, it's a compact, screenless device that attaches to clothing and functions as a conversational AI assistant. It emphasizes a screen-free experience and offers security features. Pin AI operates independently of a smartphone, thanks to its Qualcomm chip, and aims to provide an ad-free experience with software subscriptions. However, competition is brewing, as OpenAI CEO Sam Altman is reportedly working on a rival AI device with Jony Ive, adding complexity due to Altman's significant stake in Humane. Exciting developments in the AI wearable market are on the horizon. 💡 AI Hacks and Tricks

💰 Follow The Money

🧰 AI Tools of the DaySM Marketing.

🚀 Showcase Your Innovation in the Premier Tech and AI Newsletter (link) As a vanguard in the realm of technology and artificial intelligence, we pride ourselves in delivering cutting-edge insights, AI tools, and in-depth coverage of emerging technologies to over 55,000+ tech CEOs, managers, programmers, entrepreneurs, and enthusiasts. Our readers represent the brightest minds from industry giants such as Tesla, OpenAI, Samsung, IBM, NVIDIA, and countless others. Explore sponsorship possibilities and elevate your brand's presence in the world of tech and AI. Learn more about partnering with us. You’re a free subscriber to Yaro’s Newsletter. For the full experience, become a paying subscriber. Disclaimer: We do not give financial advice. Everything we share is the result of our research and our opinions. Please do your own research and make conscious decisions. © 2023 Yaro Celis |