📊 Metaverse by the Numbers

🌌🗺 How big is the Metaverse?

💻⚙️ Metaverse Needed Tech

This installment brought to you by Remote Web3 Jobs

🤔 Challenges for the Verse

🔌 Computer Demand for the Metaverse to function

🧰 The Metaverse Use Cases

Conclusion..

The metaverse market size was valued at a whopping $100.27 billion in 2022 and is projected to grow by $1,527.55 billion by 2029.

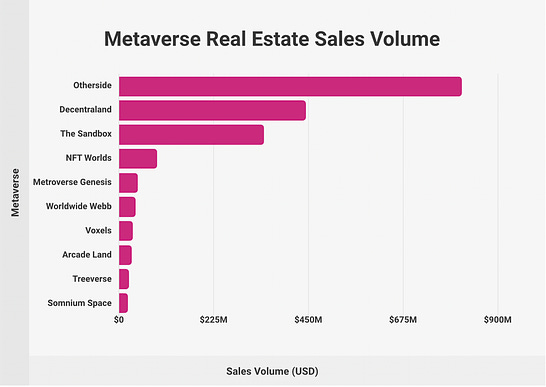

The biggest metaverse real estate transaction was a $5 million purchase by Curzio Research for 19 commercial properties in TCG World. The deal was announced on May 22, 2022.

The average price among the top 10 metaverse deals is $2.06 million, enough to buy a below-average real-world home in places like Hollywood Hills, Beverly Hills, or Malibu. The top ten all-time virtual real estate deals combined is $20.6 million. Seven of the top 10 real estate deals happened in Decentraland.

There are 622,436 total parcels of land in the ten largest metaverses.

Since their inception, the ten largest virtual world platforms have produced $1.9 billion in real estate sales.

The digital real estate market is expected to increase by $5.37 billion from 2022 to 2026, at a CAGR of 61.74%, though the recent cool-off should temper expectations.

The metaverse, which combines physical reality with augmented and virtual reality, is expected to grow more popular in 2023, with companies like Microsoft, Meta, Epic Games, and Nvidia leading the way.

The metaverse will have social and economic systems in place where users can enjoy a wide range of content with unprecedented interoperability. Experts predict the metaverse will facilitate new forms of human connections, work, leisure, and even travel.

In the metaverse, non-fungible tokens are a new type of virtual asset that has powered much of its growth, with blockchain a key facilitator in transactions. Gaming has some of the earliest metaverse experiences, and the metaverse can help increase game engagement, virality, and monetization.

These virtual worlds that combine augmented and virtual reality (AR and VR) with our physical reality have a great potential impact on various industries.

According to Forbes, the metaverse is one of the top ten trends to watch out for this year. Global spending on VR/AR, the foundation technologies of the metaverse, is projected to increase from $12 billion in 2020 to $72.8 billion in 2024. This growth is driving companies in industries such as gaming, retail, arts, healthcare, and blockchain to position themselves as critical players in this emerging ecosystem.

The metaverse concept is enormous, and there will likely be a variety of metaverses, each with a specific focus, such as gaming or sports. Meta's vision is a 3D social media channel with AI-driven messaging tailored to each user. The metaverse will also likely become a hub for information, entertainment, and work, and could evolve into the next version of the internet.

AR/VR handsets: These devices are still pricey ($200 - $3k+) and clunky to use. As of now, their use are limited to virtual worlds. In the future, we may have regular everyday glasses fitted with technology to allow us to jump into any virtual world.

Haptic Technology: Is the use of tactile sensations to stimulate the sense of touch in a user experience. Gloves, vests and full outfits can make us feel the metaverse as we feel the present world. There are various companies developing haptic technology which willbe a game changer in the industry.

Artificial Intelligence (AI): AI is important in the metaverse as it can enable virtual characters and objects to behave in a more lifelike and natural way. It can also be used to develop intelligent assistants to help users navigate the metaverse and provide personalized experiences.

Blockchain: Blockchain technology can be used in the metaverse to enable secure and transparent transactions, manage virtual assets and currencies, and create a decentralized governance model.

Cloud Computing: The metaverse requires a significant amount of computing power to support real-time rendering and interactive environments. Cloud computing can provide the necessary scalability and processing power to support a large number of users and deliver a seamless experience. We are by far not at a point where we can render worlds in seconds for thousands of simultaneous users.

Internet of Things (IoT): IoT devices can be used in the metaverse to enable physical objects to interact with virtual worlds. This can create new opportunities for immersive experiences and enable a more seamless integration of the physical and virtual worlds.

This weeks installment is brought to you by Remote Web3 Jobs:

Interoperability: As the metaverse is a complex system with multiple components, protocols, and platforms, there is a need for standardized protocols and interfaces to ensure interoperability. Without standardization, different metaverse systems may not be able to communicate effectively, leading to fragmentation and limiting users' ability to move between different virtual worlds. As of now, interoperability is a challenge since different metaverses abide by different rules, and use different devices and operating systems. The company that creates interoperability in the metaverse and allows users to jump from one to another and use their virtual properties seamlessly has the potential to become a big player in the industry.

Interoperability challenges for the metaverse include:

Standardization is crucial for different systems to work together effectively.

Content and asset portability is essential for users to seamlessly move between different virtual worlds.

Identity management requires a robust system to maintain a consistent user identity across different platforms.

Intellectual property challenges include ownership, licensing, and copyright.

Governance models must be established to enable interoperability while protecting user rights and ensuring public safety.

Scalability: The metaverse requires a massive amount of computing power to support a large number of users and provide real-time rendering of complex virtual environments. Ensuring that the system can scale effectively to handle a rapidly growing user base is crucial.

Latency: In a metaverse environment, even small delays in rendering or processing can be noticeable to users and detract from the overall experience. Reducing latency and ensuring that the system can deliver real-time performance is essential.

Bandwidth: The metaverse requires high-speed connectivity to enable real-time communication and collaboration between users. Ensuring that the system has sufficient bandwidth to support a large number of users is crucial.

Hardware Requirements: To access the metaverse, users will require high-end computing hardware, such as a powerful graphics card, high-resolution display, and fast processor. Ensuring that the system is compatible with a broad range of hardware configurations and can run smoothly on lower-end hardware is crucial to broadening the user base.

Energy Consumption: The metaverse requires a significant amount of energy to power the servers and data centers required to support the system. Ensuring that the system is energy-efficient and environmentally sustainable is becoming increasingly important.

Education: The metaverse has the potential to transform the way we learn by providing immersive and interactive learning environments. It can enable students to learn through simulations, virtual field trips, and interactive lessons, making education more engaging and effective.

Entertainment: The metaverse offers endless possibilities for entertainment, including virtual concerts, festivals, gaming, and social events. Marshmello debuted in the metaverse in 2019 and Travis Scott had 28 million viewers watching his concert in 2020. It provides a new way to experience entertainment, creating immersive experiences that can bring people together from around the world.

Marketing: The metaverse has the potential to revolutionize the marketing industry by enabling brands to create immersive experiences that engage consumers in new and exciting ways. The luxury brand Gucci has conducted multiple brand activations to figure out where and how to connect with Gen Z. Last year, it drew 19.9 million visitors in two weeks when it launched a metaverse version of its real-world Gucci Garden on Roblox.

Transactions: The metaverse can enable virtual transactions, such as buying and selling virtual goods, digital assets, and virtual real estate. It can provide a new platform for e-commerce and can revolutionize the way we buy and sell products and services.

The Metaverse is a complex system that offers social and economic systems where users can enjoy various contents with unprecedented interoperability. The metaverse has a massive market size, and its digital real estate market is expected to increase by $5.37 billion from 2023 to 2026.

The metaverse offers new forms of human connections, work, leisure, and even travel. However, there are still several challenges in the metaverse, including the need for standardized protocols and interfaces to ensure interoperability.

The metaverse needs different technologies such as AR/VR handsets, haptic technology, artificial intelligence, blockchain, cloud computing, and Internet of Things devices to function. With the growth of the metaverse industry, companies in various sectors are positioning themselves as critical players in this emerging ecosystem.