TOGETHER WITH  | Good Thursday to you! Almost every month for the past year Zillow has revised its 12-month home price outlook downward. That changed this week. Can you guess by how much Zillow economists now expect U.S. home prices to rise between January 2023 and January 2024? a. 0.5%, b. 5%, c. 15%? Follow the wave 🌊 below for the answer. The money topics for today are: - What's rent-to-own?

- The market laggards are getting overlooked

- Is it time to ditch your bank account?

| |

HOUSING What's Rent-To-Own? | | | | When we think of housing, what most often comes to mind is the typical options available: renting or owning. In actuality though, there is a rare third option, and it's called rent-to-own. Rent-to-own 101 - The contract: A rent-to-own agreement is essentially a two-part contract—it's a standard rental agreement with the option to buy the home after a few years of renting. There are other variations too, like lease-option which gives you the option to purchase after the lease is up, and lease-purchase which requires you to buy when the lease comes due.

- The money: In most cases with a rent-to-own, you usually pay a bit more in rent than the fair market value. This extra money then becomes your down payment at the end of the lease. And sometimes there's also an "option-fee" that's usually an upfront one-time fee of about 1-7% of a home's value that gives you the option to buy at the end of the lease.

- Risks: That one-time payment for the option to buy is a big loss if you don't purchase. Also, if you can't qualify for a home loan at the end of the lease, you'll have to give up your right to the property, and the owner then may decide to sell it or put it up for rent. Lease-purchase agreements can also be a nightmare to get out of in the event you can't follow through.

- Benefits: The key benefit of rent-to-own is that it gives the tenant the chance to save money for a downpayment while giving them the chance to "test drive" the place. And since most rent-to-own agreements split repair responsibilities between the tenant and the landlord, you may be able to save on repair costs.

- How to find one: Other than reaching out to realtors in your local network, there are companies like Home Partners of America (acquired by Blackstone) and startups like Divvy Homes and Landis that are looking to scale rent-to-own.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it:

| | | |

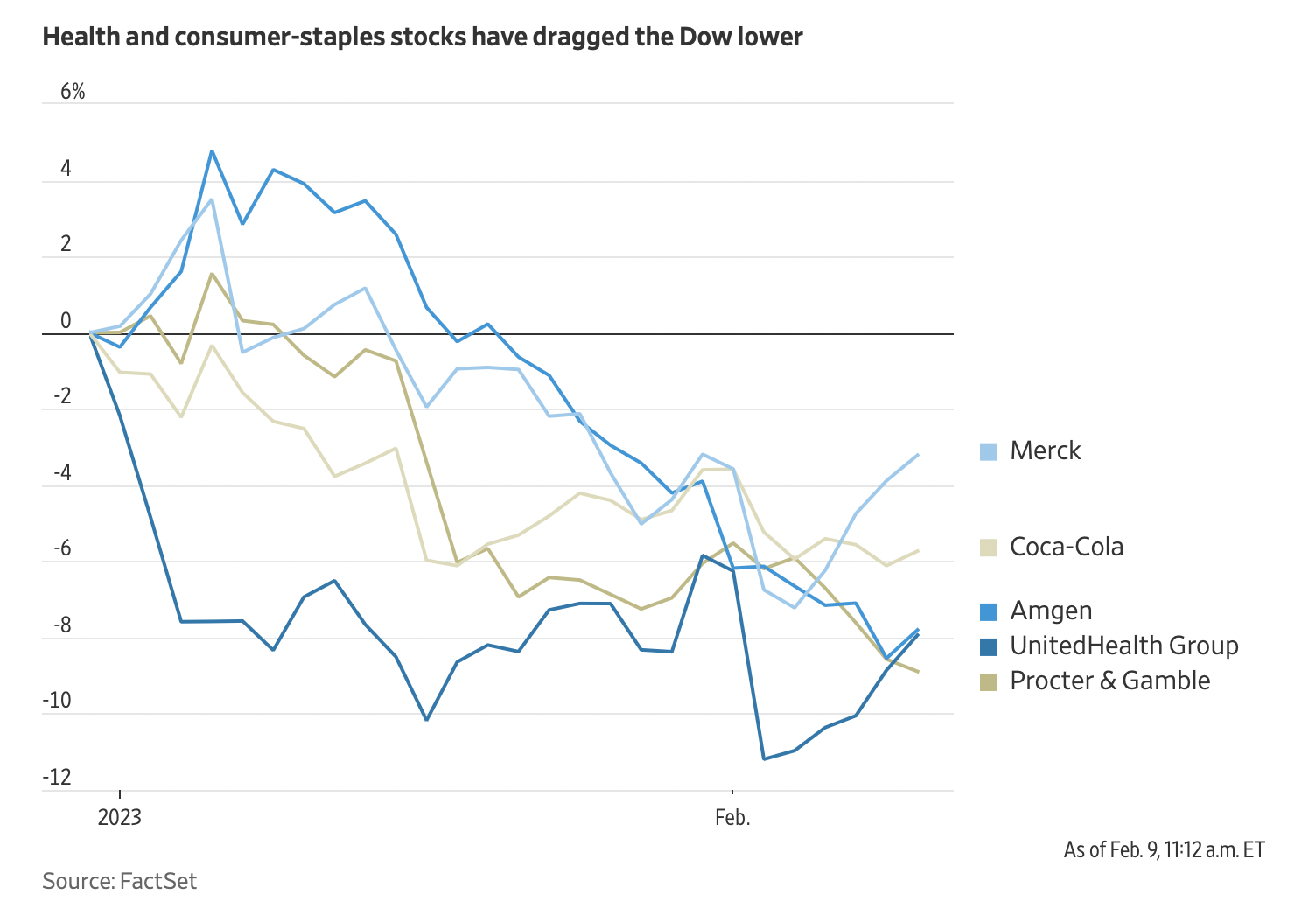

MARKET OUTLOOK The Market Laggards Are Getting Overlooked | | | | The market operates in cycles. We know this and are often reminded of it, but it never fails to turn heads no matter how many times it happens. This couldn't be more true for what we're observing right now. Amidst a new year's market rally and a sigh of relief, the laggards are getting overlooked. Left behind - The Dow difference: Unlike the Nasdaq and the S&P 500, the Dow Jones is a price-weighted index, meaning stocks with a higher share price exert more influence on the index's overall price. Also worth noting is that the Dow consists of only 30 large companies, unlike that of the Nasdaq Composite with over 3600 stocks, and the S&P 500 index including about 500 companies.

- Good in the bad times: The Dow is known for the defensive nature of its holdings — with companies like Walgreens, 3M, UnitedHealth Group, Chevron, Visa, and others. This worked in its favor during a volatile 2022 as the Dow faired best out of all 3 major indexes, ending the year down only -8.74% (vs. -19.4% for the S&P 500, -33.47% for the Nasdaq Composite).

- Lackluster in the good: So far in 2023, that old economy defensiveness has slowed it down. While the S&P 500 and the Nasdaq are up 8% and 15% respectively, the Dow has managed to eke out a measly 2.9% gain. Because of its price-weighted nature, it's being anchored by losses coming from big names like Amgen, UnitedHealth, and Johnson & Johnson.

- Why this is happening: The cyclical nature of the markets strikes again here. Investors treaded lightly back into tech and high growth in the early days of 2023, but the ice has been tested. For the moment, the mood of the markets is a cautiously optimistic outlook that's steering investors away from barge-sized market cap giants for safety, and towards the growth & tech-oriented areas of the market.

The outlook While we don't know what a year will hold until it's over, it's impossible to ignore the resounding start that the S&P 500 and Nasdaq are off to. While there are sure to be additional corrections and turbulence along the way given persisting economic uncertainty, these broad market indexes are enjoying their relief for the time being. Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

FEATURING MASTERWORKS | | | | A million-dollar Banksy got investors 32% returns. Mm-hmm, sure. So, what's the catch? We know it may sound too good to be true. It's not only possible, it's actually happening—and thousands of investors are smiling all the way to the bank, thanks to the fine-art investing platform Masterworks. Masterworks has built a track record of 8 exits, the last 3 realizing 10.4%, 35%, and 13.9% net returns even while financial markets plummeted. But art? Really? Okay, skeptics, here are the numbers: - Contemporary art prices: Outpaced the S&P 500 by 131% over the last 26 years

- Have the lowest correlation to equities of any asset class

- Remained stable through the dot-com bubble and '08 crisis

Offerings can sell out in just minutes but The Gist readers can skip the waitlist with this exclusive link. See disclosures below. | | | |

MONEY TIP Is it Time to Ditch Your Bank Account? | | | | The pandemic did a lot of things to life as we know it, but it also helped shed some light on the fact that we've been settling when it comes to the return our savings can yield us. Through suddenly flush savings accounts, historic inflation, and savings rates taking off like a rocket, account holders have relearned something they already knew — we can do better, and we will. Yield seeking is in - What's happening? When the FOMC elects to raise the Federal Funds Rate, banks usually respond in unison by also raising their interest rates—both on debt and saving products. The relationship between the two is loose, but the primary reason banks do this is to attract more deposits at a cheaper rate than what they'd be paying for an overnight loan from another bank.

- Savings rates: Brick-and-mortar, old-school banks are slower to react to the Fed's rate hikes, and even when they do, the results are lackluster — the average savings account rate is still just 0.23% APY, according to Bankrate's Feb. 1 weekly survey of banking institutions. Elsewhere though, online banks are now consistently offering rates north of 3.5%, and customers are switching in droves as they realize their potential earnings.

- Alternative methods: Cash-management accounts like those offered by the likes of Robinhood, Fidelity, and Wealthfront are becoming increasingly popular as a checking account alternative. As opposed to earning 0.05% on your cash, these brokerage firms allow investors to hold cash on their platform, earn a much higher yield, and spend or invest their cash from the same account.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

🌊 BY THE WAY | - 🏠 Answer: Zillow economists now expect U.S. home prices to rise 0.5% between January 2023 and January 2024. That's slightly improved from its previous 12-month outlook of a 1.1% decline (Zillow)

- 🧱 Home builder sentiment sees biggest monthly jump since 2013 (CNN)

- 📊 ICYMI. What to expect from interest rates this year (Finny)

- 🏙️ U.S. cities where rent prices fell the most in January (CNBC)

- 💰 Finny lesson of the day: With rates fluctuating, and home-building sentiment improving, some prospective homebuyers are asking whether they can and should tap into their retirement savings to buy a home:

| | | |

| |

| Masterworks disclosure: "Net Return" refers to the annualized internal rate of return net of all fees and costs, calculated from the offering closing date to the date the sale is consummated. IRR may not be indicative of Masterworks paintings not yet sold and past performance is not indicative of future results. See important Regulation A disclosures at masterworks.com/cd. Finny is a financial wellness platform. The Gist is Finny's twice-a-week (Tues & Thurs) newsletter covering personal finance, market trends and investing insights. The content team: Austin Payne, Carla Olson. Finny does not offer investment and stock advice. Please support our corporate sponsor—Masterworks—as they make rewards on our platform possible. If you're is interested in sponsoring The Gist, please reach out to us. And if you have any feedback about this edition or anything else, please email us. | | | | | | | |

No comments:

Post a Comment