| If you are serious about learning more about the tech and crypto space, please subscribe and get a FREE private one-on-one session in which you can ask any questions about crypto and web3 that you may have. Subscribers ALSO get exclusive, subscriber-only content during the week, access to our community, and classes and book discounts" Subscribe this month and get 15% off

Subscribe now (15% OFF) Invite friends...

Contents: 🗞️ Highlights of the Week ❓ What is Tokenization 👍 Benefits of a Tokenized Economy 🪙 Types of Tokens 🐕🦺 TaaS - Tokenization-as-a-Service ✔️ List of Companies Tokenizing 👴🏽 Tokens before Tokenization 👎 Tokens Drawbacks

This week we explored the world of Tokens and how tokenization can change any industry and the world. Tokenization is the process of converting sensitive data into a unique identifier or token, that retains essential information about the original data without exposing it to potential security risks. In other words, tokenization replaces sensitive data, such as credit card numbers or personal identification information (PII), with a randomly generated string of characters that can be used in place of the original data in a specific context.

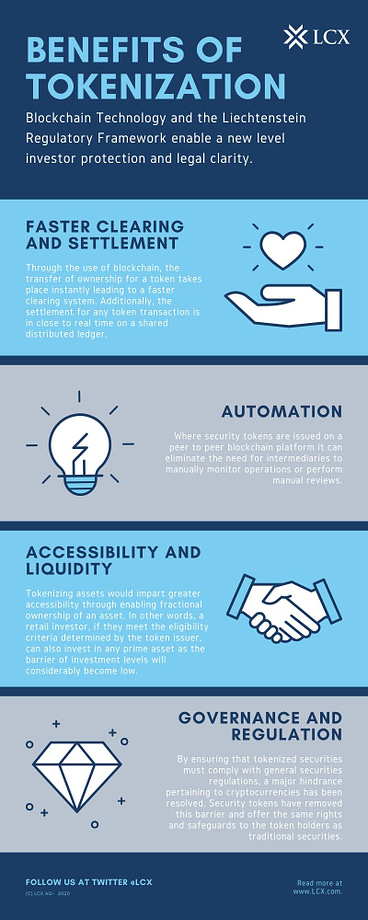

Improved liquidity: By tokenizing an asset, it can be traded on blockchain-based marketplaces, making it easier for buyers and sellers to find each other and complete transactions. This can improve the liquidity of the asset, making it easier to buy and sell. Fractional ownership: Tokenization allows for the creation of smaller units of ownership in an asset, making it easier for more people to invest in and own a piece of the asset. This can open up investment opportunities to a wider range of individuals and institutions. Transparency and security: Tokenization on a blockchain provides a transparent and secure ledger of ownership and transaction history for the asset, making it more difficult to counterfeit, manipulate or commit fraud. Lower transaction costs: Tokenization can reduce the need for intermediaries such as banks or brokers, which can lower transaction costs and reduce fees associated with buying and selling the asset. Increased accessibility: Tokenization can make investing in certain assets more accessible to a wider range of people who may not have had access to such investments previously, such as art or real estate.

Tokens are broadly categorized into the following two types: Utility tokens: Simply coins or user tokens that allow future access to the products or services offered by a company. Utility tokens are, thus, not created to be an investment. (DAO Tokens, airline miles) Security tokens: Digital assets that derive their value from a real-world asset (such as real estate, art, commodity, illiquid asset, etc.) that can be traded. Thus, security tokens are subject to federal laws that govern securities (shares in a company, digital currencies). Fungible vs Non-Fungible TokensFungible tokens are like identical Lego blocks that you can stack and use interchangeably with other blocks of the same size and shape. They are all worth the same and can be exchanged for each other. Non-fungible tokens (NFTs) are like special edition Lego blocks that are unique and can't be exchanged for other blocks of the same size and shape. They have different designs, colors, and patterns that make them one-of-a-kind. Fungible tokens are used for things like buying and selling things online, while non-fungible tokens are used to prove that you own something special and unique, like a rare toy or a piece of art. Think of fungible tokens as being like dollar bills, while non-fungible tokens are like rare collectibles, such as baseball cards or stamps.

Tokenization-as-a-service is a business model offered by Web3 companies that allows asset owners, brands, collectors, and intellectual property holders to create an NFT backed by physical and/or digital goods. There is no limit to what type of assets can be tokenized, but they’re usually assets of value like rare collectibles, art, or cultural memorabilia. The resulting NFT acts as a collectible in and of itself, as well as a representation of ownership of the physical item. When someone buys, sells, or trades the NFT on a digital marketplace, ownership of the physical item transfers along with the NFT.

MasterWorks - The first platform for buying and selling shares (fractions) representing an investment in iconic artworks. Konvi - Platform that enables users to gain partial ownership of luxury assets, such as fine watches, wine, whiskey, and more. Otis - Marketplace for alternative assets such as collectibles, fine art, and physical spaces. On March 9th, 2022, Otis was acquired by Public. Dibbs - Platform for people to sell and buy sports cards. Each sports card on Dibbs has a corresponding NFT (Non-Fungible Token) containing relevant data the assets. FranShares - Digital platform specializing in wealth-building alternative investment opportunities and helps users invest in franchise portfolios. Rally - Platform where unique, high-value assets are securitized, split into shares, and then offered up as equity investments to users of all income levels. ArtSquare.io - Fine art & collectibles tokenization platform relying on the blockchain to allow users to buy and trade art like stocks on the financial market. Art.sy - Platform for learning about and collecting art online, from top galleries, museums, art fairs, and auction houses. Acquicent - Gives access to high-value luxury assets such as vintage cars and fine art while enabling owners of those assets to turn their equity into cash. Mintus - Trading platform for contemporary artwork. Allows users to buy, share, and invest in contemporary art, asset mgmt, and alternative and fractional investment.

Fundrise - First crowdfunded real estate project in the US, leverages technology to raise funds to build real estate project. reAlpha - Provides a digital marketplace that enables its members to simplify wealth creation through investments in short-term rental properties. CrowdStreet - Online, commercial real estate investment marketplace. The company's solutions allow real estate developers and operators to accelerate their fundraising processes. YieldStreet - Aims to change the way wealth is created by providing access to asset-based investments historically unavailable to most investors. CalTier - Operates an equity crowdfunding platform that opens the door to professionally managed institutional-grade multi-family investments not typically available to real estate investors. Lev - Operates a SaaS-based lending marketplace. The company's platform provides access to quotes from lenders and services include issuing non-recourse loans. AlphaFlow - Automated real estate investment management service, offering automatic portfolio diversification for real estate investments. AcreTrader - Offers a platform that connects buyers, like individual investors, family offices, or investment funds, to farmland that is available for purchase. Roofstock runs an online marketplace where retail and institutional investors can buy and sell rental homes in the United States. Groundfloor - Opens private capital markets to all. Groundfloor is qualified by the U.S. Securities & Exchange Commission to offer direct real estate debt investments.

Sound creates a more interactive relationship between artists and fans through its Web3-based NFT platform. Digimarc develops solutions for licensing intellectual property for audio, visual and image content by integrating blockchain into its technology to help license music. MediaChain (now a part of Spotify) is a peer-to-peer, blockchain database for sharing information across different applications and organizations. In addition to organizing open-source information by issuing unique identifiers for each piece of information, MediaChain also works with artists to ensure they are paid fairly. Royal turns music fans into invested partners, providing a platform where listeners can purchase a percentage of a song’s royalties directly from an artist. Open Music Initiative (OMI) - Nonprofit calling for open source protocol in the music industry. It explores the use of blockchain to help identify the rightful music rights holders and originators so they can receive fair royalty payments. Musicoin is a music streaming platform that supports the creation, consumption and distribution of music in a shared economy. OneOf serves as a space where users can buy and exchange NFTs related to the areas of sports, music and lifestyle. Async Art is a creator platform that allows artists to develop music and sell songs in an NFT marketplace. Mycelia is a collective of artists, musicians and music lovers looking to empower creatives in the music industry. Mycelia primarily wants to run an entire database on blockchain to ensure that artists are paid fairly and acknowledged quickly. Zora is an NFT marketplace protocol where creatives can publish their work as tokens, sell them to buyers and collect profits. Rather than create copies of an NFT, Zora offers a model where an original NFT is accessible to anyone and sold repeatedly. Give a gift subscription

Before the emergence of blockchain and Web3, there were several companies that used centralized token systems for various purposes. Here are a few examples: Disney Dollars: Disney Dollars were a form of currency created by the Walt Disney Company in the late 1980s. These colorful paper bills could be used at Disney theme parks, resorts, and stores, and were often used as souvenirs by visitors. Chuck E. Cheese Tokens: Chuck E. Cheese is a popular chain of family entertainment centers that offer games, rides, and food. The company has used tokens as a form of currency since its inception, allowing customers to exchange cash for tokens that can be used to play games and redeem prizes. Casino Chips: Casinos have used tokens or chips as a form of currency for many years, allowing customers to exchange cash for chips that can be used to gamble on various games and could be redeemed for prizes and/or more tokens. Airlines: Airline miles, also called frequent flyer miles, are the airline’s currency (Tokens) that you can use by redeeming them for flights, hotel stays, and other rewards. Some airlines call their currency "points" rather than miles, but the concept is the same. Miles can be used to book flights — both on that specific airline and potentially on partner airlines.

These are just a few examples of companies that used tokens before the emergence of blockchain and Web3. While these tokens were not based on distributed ledger technology or smart contracts, they served similar functions in enabling transactions and incentivizing customer behavior.

Regulatory uncertainty: The regulatory landscape for tokens is still evolving, and there is some uncertainty around how tokens will be regulated in different jurisdictions. This can create legal and compliance risks for token issuers and investors. Market volatility: Token markets can be highly volatile, with prices subject to rapid fluctuations in response to market sentiment, news events, and other factors. This can make it difficult for investors to accurately value and assess the risk of token investments. Technical complexity: Tokenization requires specialized technical expertise and infrastructure, which can be difficult and costly to develop and maintain. This can create a barrier to entry for smaller businesses or organizations looking to tokenize assets. Security risks: Tokens and their underlying blockchain technology are vulnerable to cyber-attacks and hacking attempts. This can result in the loss of funds or compromised security for token issuers and investors. Limited adoption: Despite the potential benefits of tokenization, it is still a relatively new technology, and there is limited adoption and acceptance of tokens in the wider investment and financial industry. This can limit liquidity and access to capital for token issuers and investors.

Overall, tokenization can offer significant benefits, but it also comes with some risks and challenges that should be carefully considered before embarking on a tokenization project.

You’re a free subscriber to Yaro’s Newsletter. For the full experience, become a paying subscriber. IF YOU are serious about learning more about the tech and crypto space, please Subscribe and get a FREE private one-on-one session to ask any questions about crypto and web3 that you may have. As well as more curated information during the week and access to our community. 15%OFF this month

Subscribe now (15% OFF) or Send us some ₿ bit-love if you are partial to it: bc1qgq2ld68t0pz4m5z0zprzlvq2gnu2kzaqwhjcax or a One-time donation:

| |

No comments:

Post a Comment