Hope you're all staying calm, cool, and collected amidst the volatility! There are some things to be really excited about and some other things to be concerned about. But that's why we're here, right? Here are the money topics we'll cover today:

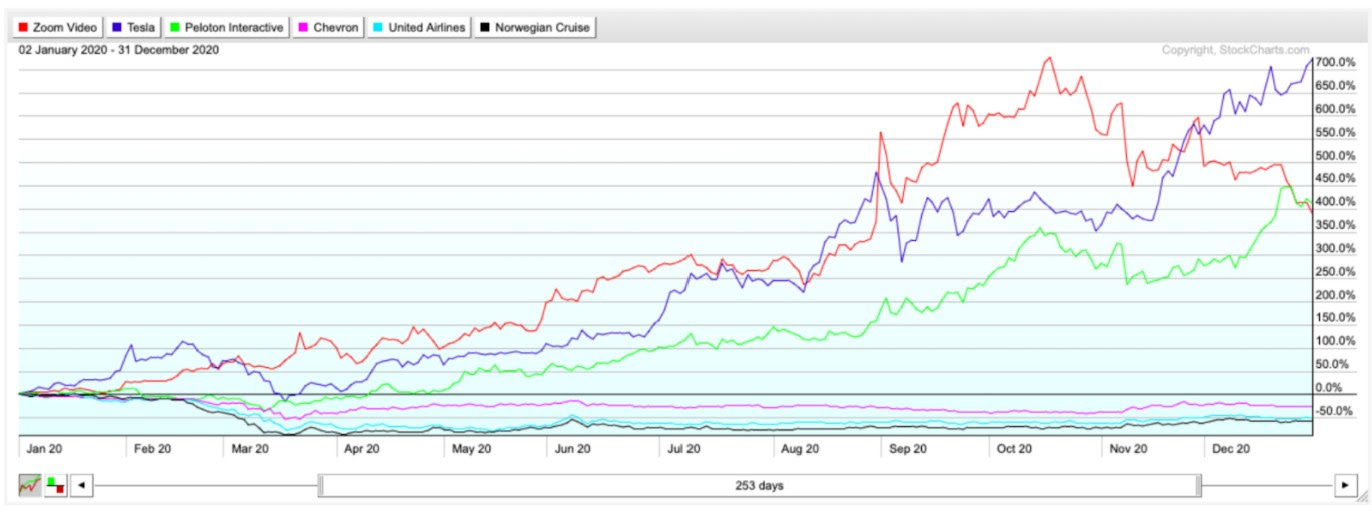

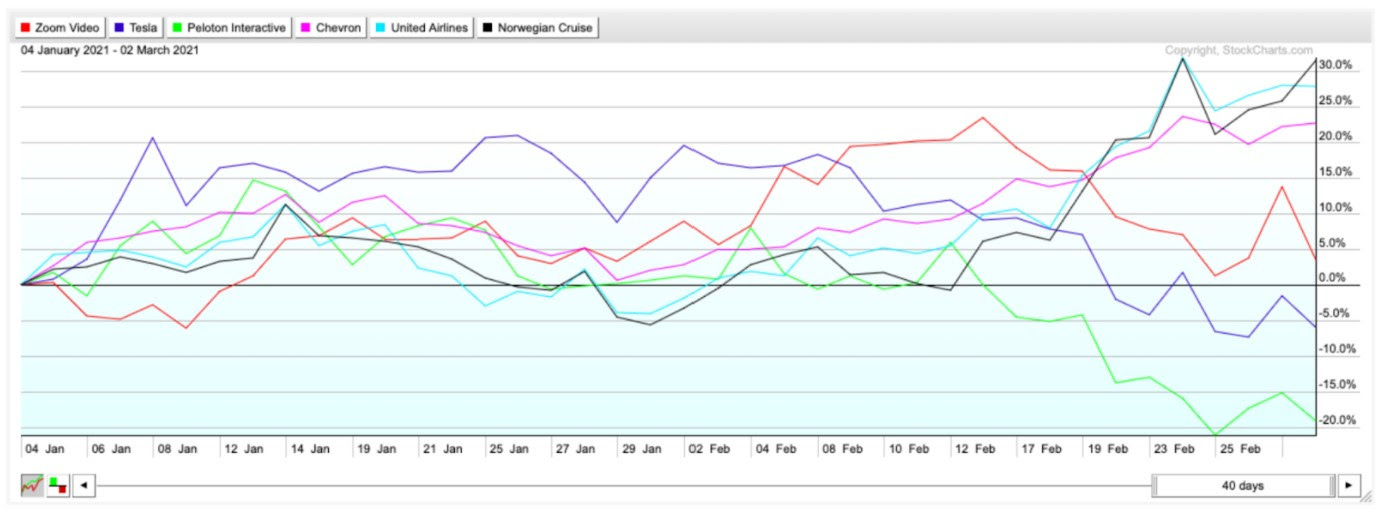

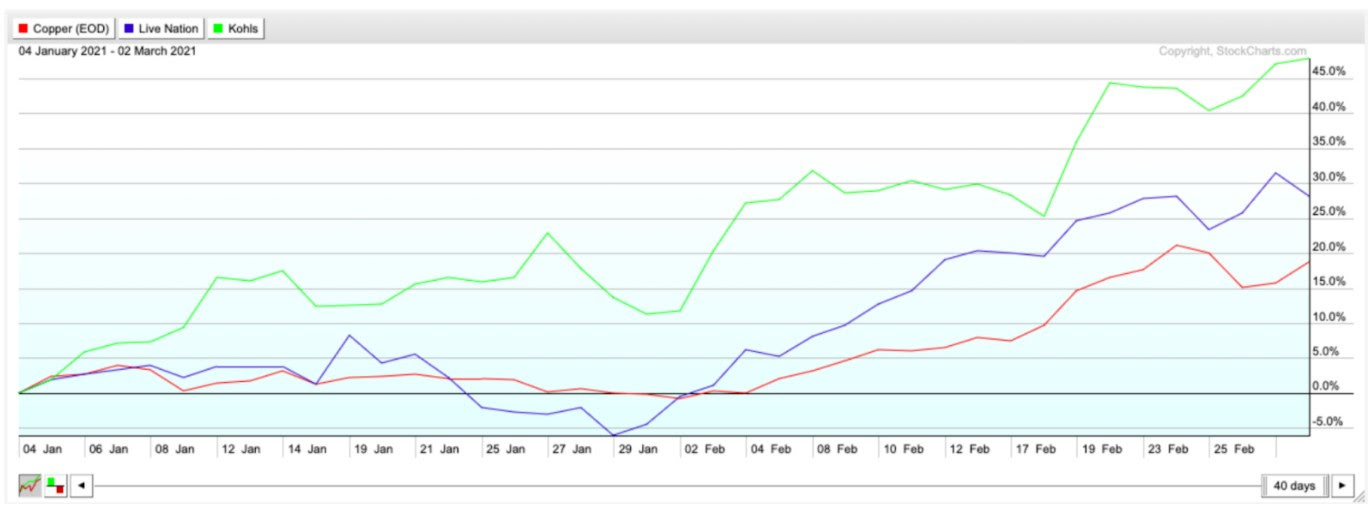

To ensure you are getting The Gist every Tuesday and Thursday, please move it to your primary folder (Gmail), or add it to your VIP (Apple Mail) or favorites (Outlook)! INVESTINGPandemic laggards are turning into leadersBack in November, right around the time of the election, we saw the beginnings of a big rotation out of pandemic winning stocks (i.e., tech) and into beaten-down small-caps, value, and names in travel, hospitality, and energy. Trendy stocks like Zoom, Peloton, and Tesla were pandemic darlings in 2020. People were working from home, exercising from home, and becoming more environmentally conscious. You can see from the chart below how laggards such as Chevron, United Airlines, and Norwegian Cruise Lines performed in comparison. It's easy to understand why these names would underperform given the pandemic. But looking ahead, how things have changed! Year-to-date, this stock chart has practically flipped. Peloton, Tesla, and Zoom are way off their highs, with Peloton significantly down almost 20% thus far. On the other hand, Norwegian Cruise Lines is up nearly 31%, United Airlines is up 28%, and Chevron more than 22%. The stock market is a forward-looking instrument, and that's what's going on here. It's what happened last March, leading to a surge in tech shares, and it's happening again now. The market is looking towards an economic rebound and reopening, even though we're not there yet. Consider this too. Look below at how copper, a vital metal to our everyday lives (and to electric vehicles, renewable energy) and a strong barometer of economic activity, has performed year-to-date. Other stocks that you would expect to perform well in a "reopening" scenario, such as Live Nation, a company that operates and manages ticket sales for live entertainment, and Kohl's, a brick and mortar retailer, have been on a roll. Our take. Picking and choosing isn't easy though. High-flying stocks are sexy, and they get our attention. But if you keep a balanced and diversified portfolio, you'll be much better off in the long-term. One sector may be hot, while another lags. But as you've seen here, it could flip tomorrow. If you're interested in learning about how to value stocks, take this bite-sized lesson: SPONSORED BY FETCH REWARDSKickstart your money savings goals with your receiptsLet’s talk about receipts. You know, those annoying slips of paper that usually end up crumpled in your pocket or purse, stuffed into your junk drawer, or worse—immediately tossed into the garbage. Unless you’re planning on returning an item (or you’re worried about getting audited by the IRS), there’s really no reason to hang onto them, right? If you have the Fetch Rewards app, you’ll start seeing your receipts differently. Go from #ReceiptsToRewards in a snap

Kickstart your money-saving goals with Fetch Rewards. Download the app and use code "FINNY" during your signup for 3,000 points on your first receipt. We love the app over here at Finny! MONEY TIPSBeware of lifestyle creep. It's sabotaging your savings.If you've ever received a raise, you're probably familiar with that urge to immediately use your newfound financial superpower. Maybe it's a fancy dinner out, a spontaneous weekend getaway, or even a riskier move to a pricey car loan. But, you've got the money, so it's alright, right? Beware of the lifestyle creep. Lifestyle creep or inflation is when your living expenses and non-essential expenditures increase with your growing income. This "creep" can make those things and activities that once seemed like luxuries become perceived necessities. In other words, this is what happens when your new standard of living creeps up and cuts into your savings. And the problem is that over time you lose sight of what you actually need. While it's important to celebrate your achievements every now and then with a fancy dinner or a nice vacation (you deserve to treat yourself after all), it's also important not to get in the habit of squandering your money. A healthy balance of awareness of your financial goals, discipline and planning will go a long way. So what should you do to resist lifestyle inflation as your salary goes up? Here are two practical, simple ideas: 💡 Fund your savings goals before making any lifestyle improvements. Basically, have a plan for any raise you might get. Consider increasing your 401(k) contribution by 1-3%, or saving 75% of every raise. 💡 Create a fun fund after paying yourself first. Doing this could help you splurge more "wisely." Some online banks or banking services, such as Ally or One Finance, allow you to create simple "buckets" or "pockets" for different savings goals. ECONOMYThe Fed says "no worries" to inflation. But are they right?Do we take Fed Chair Jay Powell's word that we're nowhere near the Fed's inflation goals and that inflation pickup is only temporary as the economy re-opens? If the Fed plans on keeping interest rates this low, allowing trillions of stimulus dollars to be pumped into the economy while surging bond yields flash warning signs, we're in for a rude awakening. Yes, this monetary policy is outstanding for stocks and for heating up the GDP. But too much of a good thing isn't always such a good thing. In fact, just this week treasuries continued to rattle our nerves as benchmark 10-year Treasury yields approached 1.5%, pricing bonds in the highest five-year inflation expectations since 2008. And more importantly, has Powell been to the supermarket lately? We're already seeing a preview of what may come at gas stations and supermarkets. According to Bloomberg, food prices are rising faster than inflation and income. This is usually an ominous sign of things to come. Plus, the January Consumer Price Index data found that the cost of food eaten at home rose 3.7% from last year and was more than double the 1.4% year-over-year increase for all goods included in the CPI. No need to worry—we'll keep trackin' over here. To learn or brush up on what is inflation and why it matters, check out this bite-sized lesson: ✨ TRENDING ON FINNY AND BEYOND

How did you like Finny's The Gist today? (Click to vote) That’s it for today. If you’ve enjoyed today’s edition, please invite your friends to join Finny. Have a great rest of the week! The Finny Team Finny is a personal finance education start-up offering free game-based personalized financial education, a supportive discussion forum, and simple stock and fund tools (aka Finnyvest). Our mission is to make learning about all things money fun and easy!The Gist is Finny's newsletter to our community members who are looking to save and make more money, protect their finances, and be their own bosses! It's sent twice a week (Tues/Thurs). The editorial team for this edition comprises Matthew Levy, CFA and Chihee Kim.Sponsors are mission-aligned partners that offer unique and valuable services at little to no cost for our users. We only feature those partners we love using ourselves. And we're thankful for their sponsorship to enable Finny to operate! Here's our advertiser disclosure.If you have any feedback for us, please send us an email to feedback@askfinny.com.If you liked this post from Finny: The Gist, why not share it? |

Thursday, March 4, 2021

🔥 Are laggards turning into leaders?

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment