Happy Tuesday everyone! As we "march" on and kick-off Women's History Month, don't forget to check out some raw stats about women & money below. Here are the topics for today:

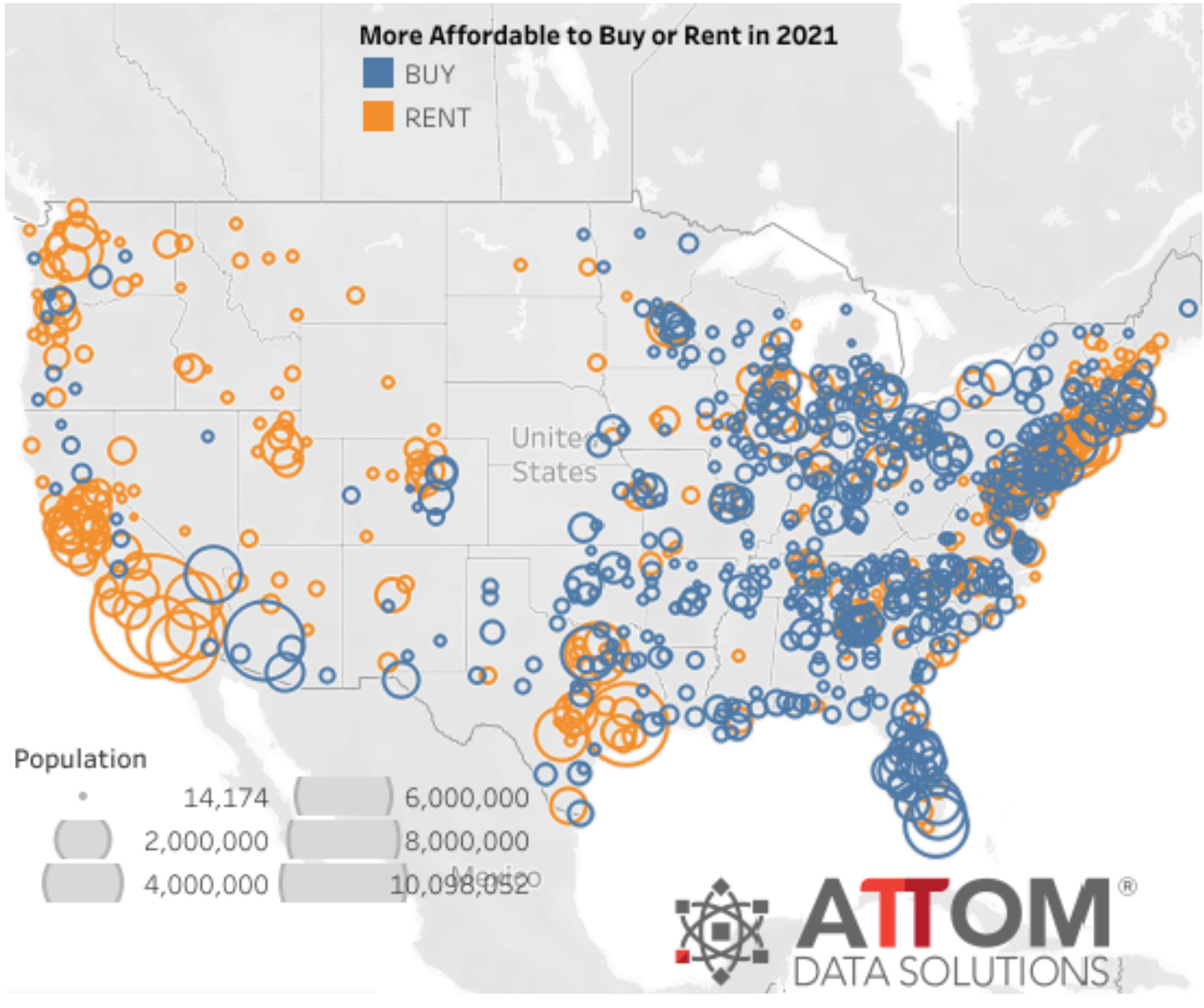

INVESTINGWhat we learned from the "Oracle of Omaha"Warren Buffett broke his silence! In his annual letter to Berkshire Hathaway investors over the weekend, he shared how he felt about his investments, the future of the country, the outlook for bonds, and advised never to bet against America. While much of the letter's focus is on Berkshire Hathaway itself, clearly staying out of larger political issues facing America such as the pandemic and racial inequality, there are some important lessons for everyday investors like us worth highlighting. When a bad investment ruins your return, look to taxes for reliefIn the world of active stock investing, diversification takes backstage. As Buffett famously once stated, "diversification is a protection against ignorance," implying he could do better when selectively investing in a handful of carefully chosen companies. But what happens when one of your stock investments or active funds woefully underperforms? You wind up with a bad apple that ruins your lunch. His big mistake: Buffett paid too much for aircraft component maker Precision Castparts (“PCC”) in 2016, resulting in an ugly $11 billion write-down (or deduction) last year. Buffett miscalculated the company's future earnings and paid more than its worth. What's a write-down? It’s an expense that reduces taxable income to help lower one's annual tax bill. In the world of retail investing, there is something similar and it's called tax-loss harvesting. When year-end approaches and you have some sizeable losses, you can net them against your gains or some other type of income you earned, so you wind up paying less in taxes. Smart, eh? Yes, we think it's pretty nifty. Buffett's return over a 55-year period is legendary. But if you're not a Buffett-like genius, stick with index investing and diversificationYou may have a lucky bet or two, like Tesla or Apple, but how hard is it to beat the market over time? Here's Buffett’s official record: from 1965-2020, his compounded annual return was an astonishing 20%, while the S&P 500 returned 10.2%. This is an amazing record given that 91% of large-cap US funds have underperformed the S&P 500 index over a much shorter ten-year period, according to S&P Global Indices. If a majority of active fund managers can't beat the S&P 500, how are we to do it? Diversification may be protection against ignorance, but it sure is a powerful tool... If the future of bonds is bleak, consider dialing back on themIn the letter, Buffett says that "fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future." That might be because of the ailing bond market caused by the pandemic, but also because in places like Japan and Germany, fixed-income investors are earning negative returns on government-issued bonds. So what can you do if you believe the future of bonds is bleak? Don't completely cut them out—they’re a major asset class. If anything, dial back on bonds and add another uncorrelated asset class to your portfolio—e.g., real estate or other tangible assets. Lastly, if you’re a fan of Buffett-style investing and would like to learn more from him, tune in for his Annual Shareholders meeting taking place virtually on May 1st at 1 pm EDT. *For those who need a refresher on investing, take our bite-sized, quiz-based lesson on the fundamentals: SPONSORED BY MASTERWORKSThe A-R-T of investingWhat’s the one thing in an ultra-wealthy investor's portfolio that you’re probably not investing in? It's literally, A-R-T. In fact, 84% of ultra-high-net-worth individuals collect art according to a recent Deloitte survey. Why? Contemporary art returned 13.6% per year over the last 25 years vs. 8.9% for the S&P 500. And with the total art market expected to balloon from $1.7T to $2.6T by 2026, it’s no wonder that the price of paintings has skyrocketed. One New York startup is at the center of it all: Masterworks. They’ve fractionalized multimillion-dollar masterpieces by KAWS, Basquiat, Banksy, and more—and you can be a part of it. If you're tired of meme stocks and are looking for a non-correlated asset class, check out Masterworks. They’ve allowed Finny members to skip the 25,000 waitlist, so skip the line and sign up today.* *See important information. HOUSINGThe buy versus rent seesawWith people flocking to the suburbs, home prices shot up in some less rural areas while rent prices slacked elsewhere. Despite the fact that median home prices grew faster than average wages or average rents in the US last year, it’s more affordable to own a median-priced 3-bedroom home in two-thirds of the US, according to Attom Data Solutions. Only a year ago it was more affordable to own a median home in half of the country. But thanks to low mortgage rates—which fell below 3% for the first time ever in January—monthly mortgage payments are now more affordable than ever. So does that mean you should jump at the chance to buy a home or a rental property now? Other than simply looking at price (and assuming you have your downpayment in order), here are two important points to consider when you make this decision.

Want to dig into this a bit more? Take our 5-minute bite-sized, quiz-based lesson on this: WOMEN'S HISTORY MONTHThe raw truth about women & moneyWith March being women's history month and international women's day right around the corner, we wanted to share with you a few raw truths and stats about Women & Money courtesy of Ellevest, whose mission is to get more money in the hands of women+.

As a start-up with a female founder ourselves, we at Finny aren't sitting around hoping things get better on this front. We 100% support women-led businesses, partners, and practice gender parity every chance we get. *The data points above are sourced from 60+ Stats About Women And Money (Ellevest Magazine). Learn more about Ellevest's dedication to achieving gender parity when it comes to money. ✨ TRENDING ON FINNY AND BEYOND

How did you like Finny's The Gist today? (Click to vote) That’s it for today. If you’ve enjoyed today’s edition, please invite your friends to join Finny. Have a great rest of the week! The Finny Team Finny is a personal finance education start-up offering free, game-based personalized financial education, a supportive discussion forum, and simple stock and fund tools (aka Finnyvest). Our mission is to make learning about all things money fun and easy!The Gist is Finny's newsletter to our community members who are looking to make and save more money, protect their finances and be their own bosses! It's sent twice a week (Tues/Thurs).Sponsors are mission-aligned partners that offer unique and valuable services at little to no cost for our users. We only feature those partners we love using ourselves. And we're thankful for their sponsorship to enable Finny to operate! Here's our advertiser disclosure.If you have any feedback for us, please send us an email to feedback@askfinny.com.If you liked this post from Finny: The Gist, why not share it? |

Tuesday, March 2, 2021

🤔 What did we learn from Buffett?

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment