Happy Thursday as we kick off March Madness here in the US! Can you guess how much 50 million Americans wagered on the college basketball tournament in pre-pandemic 2019? Find out in the "trending" section below. Let's get right to the mad money topics for today:

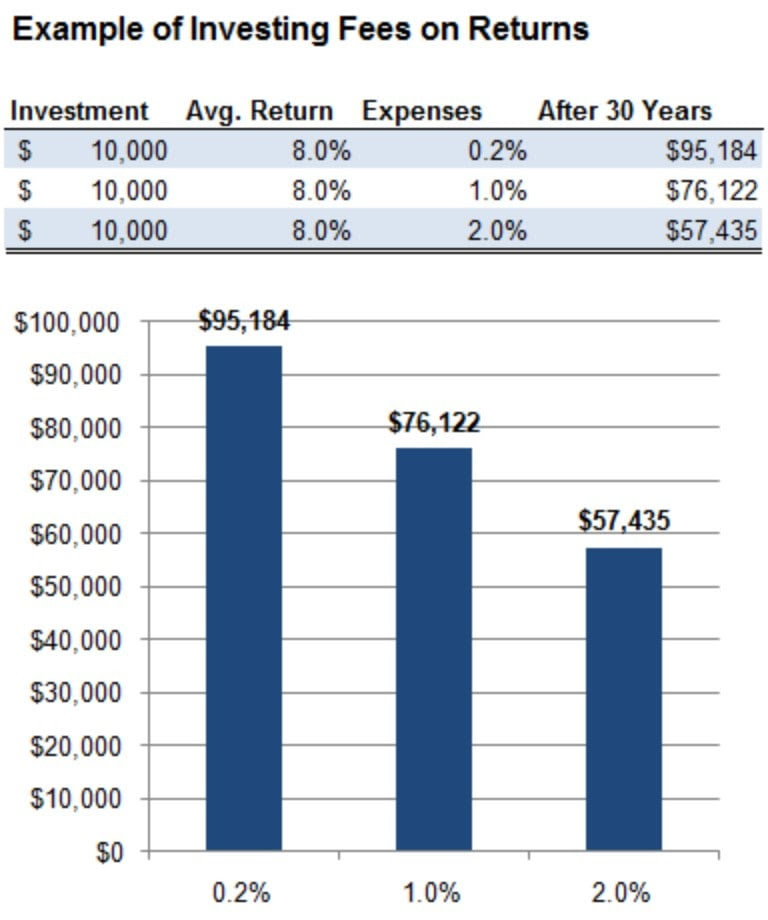

INVESTINGThe beginning of the end of mutual funds? Is there a reason to still own them?2020 was a crazy, crazy year in the stock market. It recorded the sharpest drawdown of 30% EVER (that was a bad 22 days) and the fastest recovery to new highs EVER (that was a good 6 months). And your mutual fund holdings probably did pretty well overall, as long as you didn’t panic sell in March. But did they do better than the market? According to the Wall Street Journal, some 60% of U.S. large-cap stock-picking mutual funds lagged behind the S&P 500 in 2020, and the majority of such funds underperformed 11 years in a row. Oof. Mutual funds are not created equal, so it's unfair to say you need to get rid of all of them. But when passive holdings that you can buy in exchange-traded funds (ETFs), come at a half, a quarter, or even a tenth of the cost of them and outperform for over a decade, it might be worth taking a second look at what you own. Now you might be thinking a 1% or 2% fee doesn't sound like a lot, but those fees can add up over your lifetime thanks to the magic of compounding growth. In the below chart, you can see how significantly a seemingly small fee can eat into your account balance over a 30-year period. Because investments with higher fees have to overcome these expenses, their performance tends to suffer versus lower-cost investments. So what do you do if you own mutual funds? Don't let high costs eat away at your returns. As you've probably heard a million times "past performance doesn't guarantee future results." But after 11 years of underperforming on average and paying higher fees for your mutual funds, it's time to update your investments.

SPONSORED BY BL🏀🏀🏀MWhat to do if your retirement accounts are "madness"What do you do if your retirement accounts are madness? IRA? 401k? Rollover? Double dribble? Wait. This company can help answer all those full-court pressing questions. Blooom offers tools to help you optimize and manage your retirement accounts for the fraction of the price of a traditional advisor. They help you understand these three things about your retirement investment strategy.

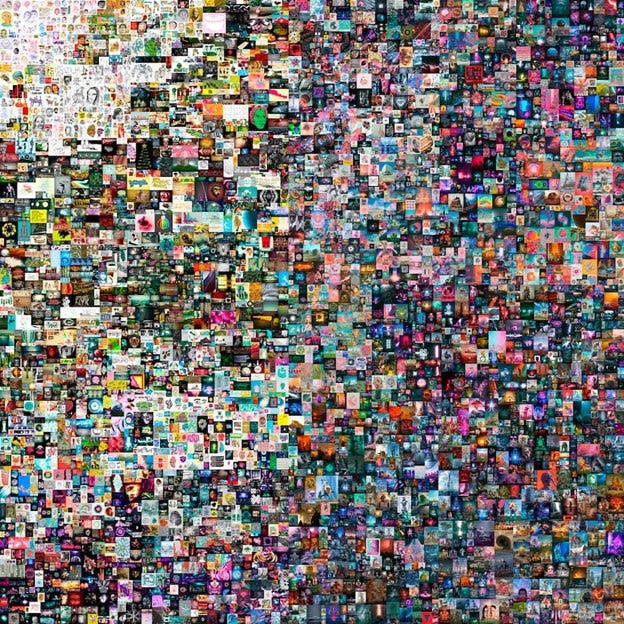

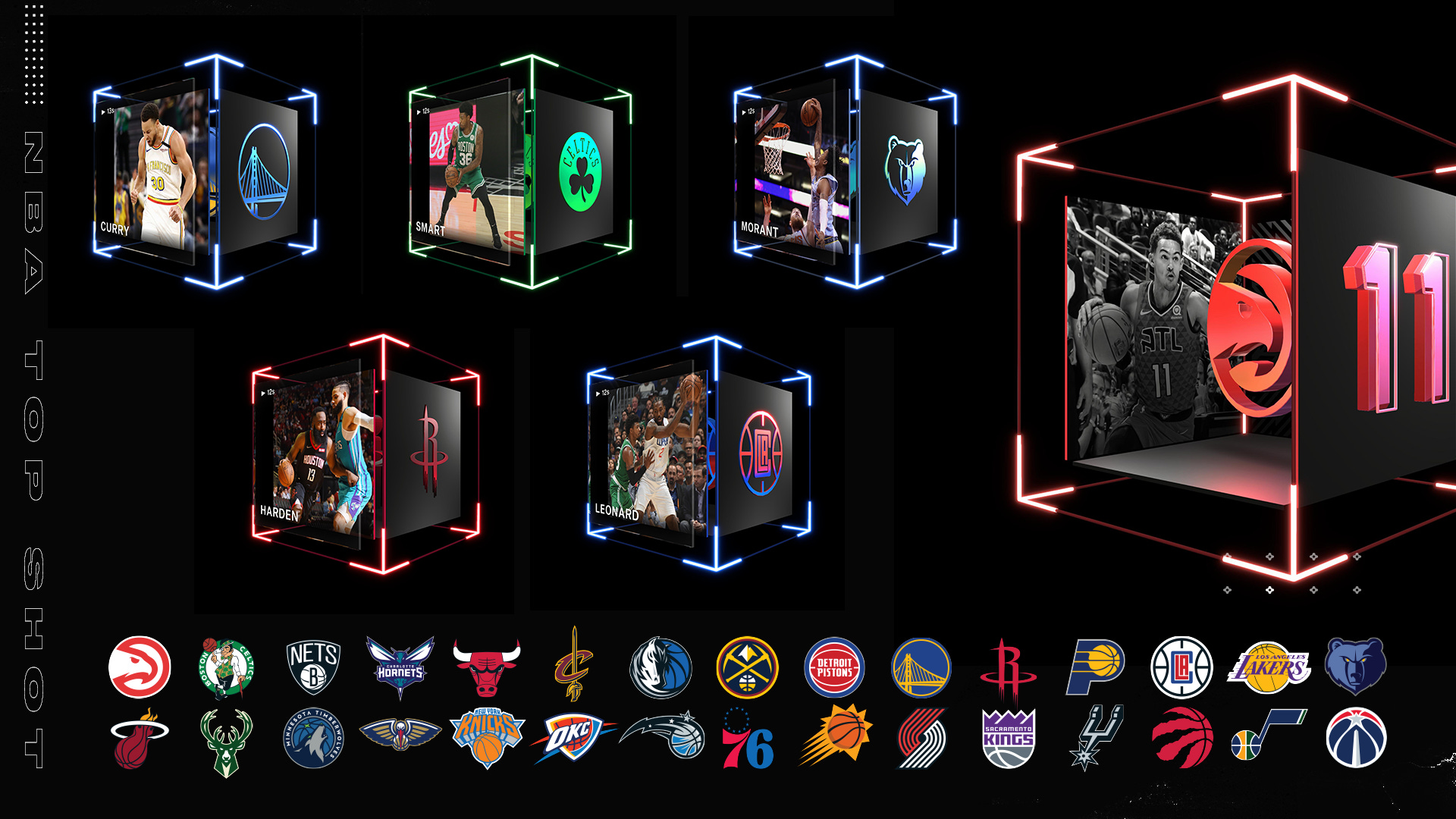

Take back control of your hard-earned dollars. Get a complimentary retirement account analysis. Think of it as a free check-up of your investments! Get $20 off if you sign up for blooom's paid service; use promo code FINNNY (yes, that's 3 Ns!). INVESTING IN NFTsWhat are NFTs? The $69 million dollar question.You may have heard the buzz around Non-Fungible Tokens or NFTs. What are they exactly? How do they work and why are people buying them? By the way, if you right-click and save the above image, congratulations, you now own a perfect $69 million dollar copy of one. To sum it up in simple English, NFTs are digital collectibles. These collectibles can contain anything digital, including animated GIFs, tweets, songs, drawings, or even items in video games. In the spirit of March Madness, let's take NBA Top Shot as an example. NBA Top Shot—a partnership between the NBA and Dapper Labs, a blockchain company—is, in its simplest explanation, an online forum for trading virtual basketball cards. Fans can buy and sell video clips of their favorite players, called “moments,” from recent seasons. And if you can imagine, these "moments" are in high demand as consumers have spent hundreds of millions of dollars on them. How do you own a "moment?" NFTs allow you to buy and sell ownership of these "moments" by keeping track of who owns them using the blockchain. Blockchain technology acts as a digital ledger, meaning everyone knows who-owns-what based on what's on the ledger. Put another way, it's a digital record book using cryptography, which makes NFTs unique, impossible to counterfeit, and immediately authenticated. And when you buy an NBA Top Shot moment, it brilliantly goes into your blockchain-linked account. You don't have to know any of the technical stuff, only what you want to buy. Why are they worth so much? Is this just a way to manufacture scarcity? NBA Top Shot drops "packs" of such moments (similar to a pack of basketball cards) to consumers intermittently, and the demand is huge and far outstrips supply. For example, in a recent pack drop, there were hundreds of thousands of buyers in line trying to get a pack, of which only 25,000 were available. And because many of these highlights are very scarce, they become increasingly valuable. A user even recently paid $208,000 for ONE highlight of Lebron James dunking on Nemanja Bjelica. So are NFTs good investments? And will they be around in ten years? Hard to say. Some will probably succeed, and many will fail and become worthless. A lot of people said that about art collecting in prior decades and in 2018 the art market hit $67.4 billion, according to UBS. Are digital NFTs the new art then? One thing's for sure: thanks to the recent $69 million sale of his digital collage, Everydays: The First 5000 Days, Beeple probably has a strong opinion on that. SAVINGWant more savings? One weird trick to helpWe all have our behavioral biases. We see them every day. On our way to work, we get the world's best cup of coffee, our hometown has the best cinnamon buns, and we all live in the best city ever. And my mom is smarter than your mom. Who's right? Simply put, we all have biases whether we recognize them or not, and the unconscious ones may be stopping us from meeting retirement goals or making better money decisions. In fact, Scientific American recently studied this and asked people to choose one of two options they'd prefer to be in:

Which would you choose? 🤔 Ready for the answer? If the investment and loan amounts are of equal amounts, option one is the slightly better choice, given the effects of compounding interest. However, the study found that a higher proportion of people with financial obligations chose option two over option one. Why? They preferred the option in which they were earning money on their savings account, even if that meant a higher interest payment on their debt. So what does this all really mean? We have a natural bias towards “earning” rather than “saving” when we’re in financial distress—not because we don’t know how to save money or we aren’t trying to save money but because we perceive earning money as a more productive way to increase financial well-being. And while in some cases it may be beneficial to prioritize earning, such as when we are looking for a new job or investing in the market, it can also hinder wealth building. One approach is simply to understand that this bias exists so you can become more aware of your own. ✨ TRENDING ON FINNY AND BEYOND

How did you like Finny's The Gist today? (Click to vote) That’s it for today. If you’ve enjoyed today’s edition, please invite your friends to join Finny. Have a great rest of the week! The Finny Team Finny is a personal finance education start-up offering free game-based personalized financial education, a supportive discussion forum, and simple stock and fund tools (aka Finnyvest). Our mission is to make learning about all things money fun and easy!The Gist is Finny's newsletter to our community members who are looking to save and make more money, protect their finances, and be their own bosses! It's sent twice a week (Tues/Thurs). The editorial team for this edition comprises Matthew Levy, CFA, and Chihee Kim.Sponsors are mission-aligned partners that offer unique and valuable services at little to no cost for our users. We only feature those partners we love using ourselves. And we're thankful for their sponsorship to enable Finny to operate! Here's our advertiser disclosure.If you have any feedback for us, please send us an email to feedback@askfinny.com.If you liked this post from Finny: The Gist, why not share it? |

Thursday, March 18, 2021

🏀 Mutual fund madness

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment