| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

Tuesday, January 31, 2023

🀟 It's just one thing after another

Sunday, January 29, 2023

📲 5 Techs to learn in 2023

Contents:

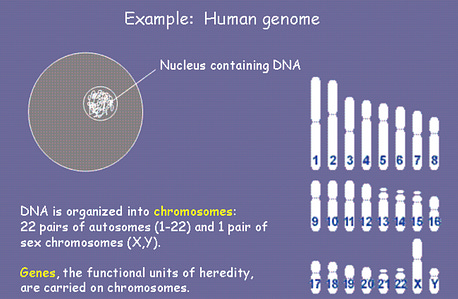

There are many technologies that are worth checking out and learning more about in order to stay up to date with the exponential tech growth that we are witnessing today. Here are 5 that we think as a must: 1. GenomeA genome is an organism's complete set of genetic material, including all its genes. It consists of DNA and is responsible for determining an organism's traits and characteristics. Genome technology has advanced significantly in recent decades due to advances in DNA sequencing and analysis methods. This has enabled faster and more cost-effective analysis of genomes, leading to new insights into the genetic basis of disease and biological processes. Learning about genome technology is important because it has a wide range of applications in fields such as medicine, agriculture, and biotechnology. For example, understanding the human genome has led to the development of new diagnostic tools and personalized treatments for genetic disorders. In agriculture, genome technology improves crop yields and creates new, more resilient crop varieties. Additionally, genome technology is increasingly important in our understanding of evolution and the diversity of life on Earth. Enter CRISPR, a gene editing technology that allows scientists to cut/edit unwanted DNA sequences and add desired traits. In the near future, we will be able to treat certain diseases using gene editing technology. 2. BlockchainWe have covered Blockchains in this newsletter at length, but nevertheless, it is important to highlight how it continues to expand and its use cases keep growing. Blockchain is a decentralized digital ledger that records transactions across a network of computers. It uses cryptography to secure transactions and ensure that once recorded, data cannot be altered. The decentralized structure of the blockchain makes it tamper-resistant, providing a secure and transparent way to store and transfer data. This has led to its widespread use in various applications such as cryptocurrency, supply chain management, digital identity, and more. Blockchain has a wide range of potential use cases, some of the most common include:

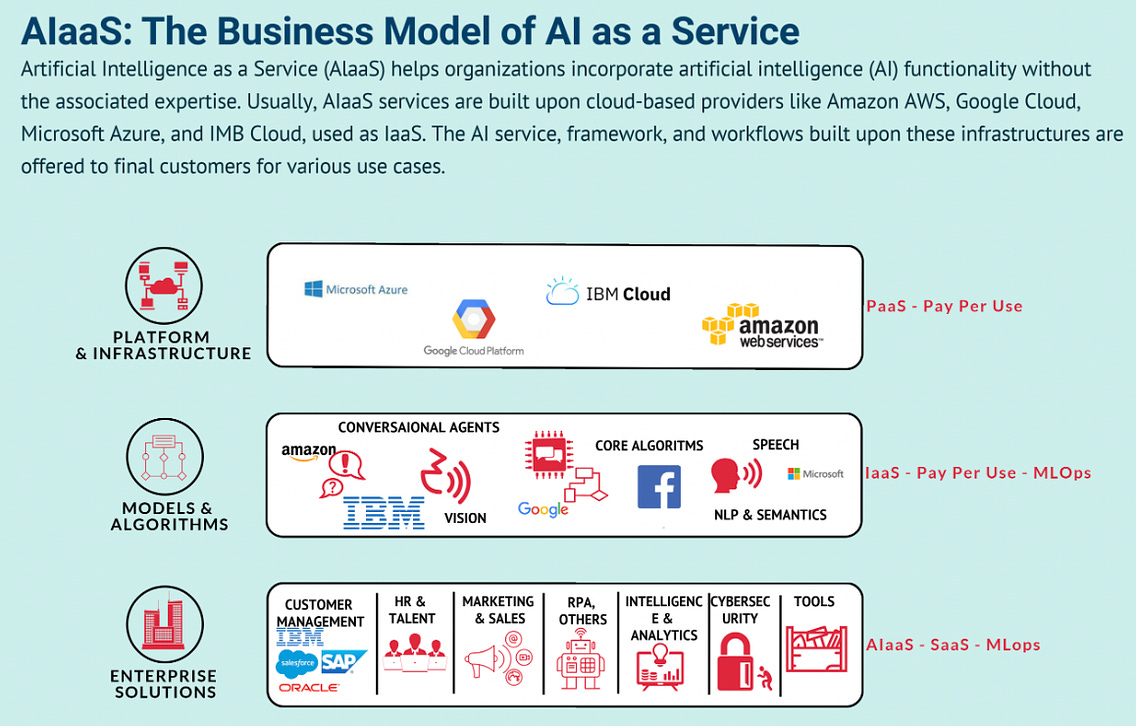

It is important to understand how a decentralized, immutable ledger can safely store information making any industry more democratic. 3. AI and AI as a Service (AIaaS)AI (Artificial Intelligence) refers to the ability of computers and machines to perform tasks that typically require human intelligence, such as visual perception, speech recognition, decision-making, and language translation. AI systems can learn from data and make predictions or decisions without being explicitly programmed to do so. There are various types of AI, including machine learning, deep learning, and natural language processing. AI is widely used in various industries and applications, such as autonomous vehicles, customer service, and finance.

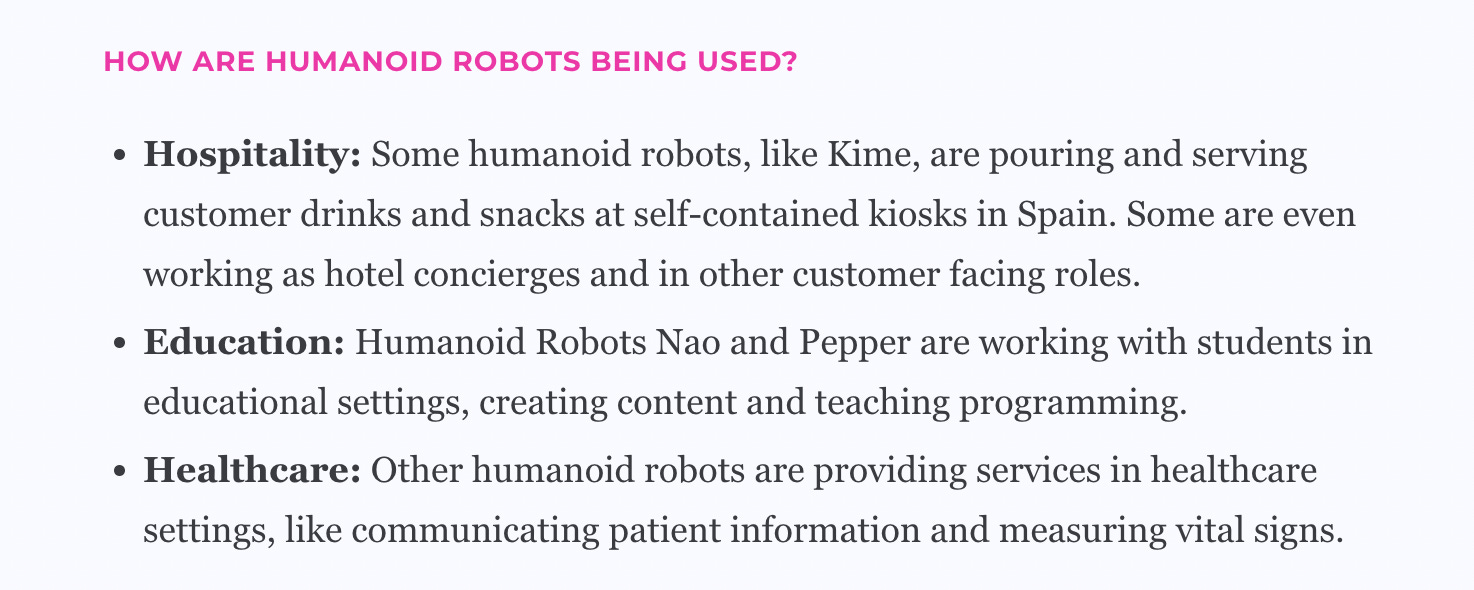

AI as a service (AIaaS) refers to the delivery of AI technology as a cloud-based service, allowing organizations to incorporate AI capabilities into their applications and processes without having to build and maintain their own AI infrastructure. AIaaS providers offer a range of AI services, such as image and speech recognition, language processing, and predictive analytics, which can be accessed and used by customers through APIs or pre-built models. This model allows organizations to quickly and easily integrate AI into their operations, without the need for significant investment in hardware and software. AIaaS has become a popular option for organizations looking to leverage the benefits of AI, without the cost and complexity of developing their own AI solutions. AI had the potential to change the way we do everything and interact with technology entirely. As AI learns more and more from the data that is being fed and robotics improved, we will see exponential advances never thought before. 4. RoboticsRobotics refers to the design, construction, operation, and use of robots. Robots are mechanical systems that are capable of carrying out tasks automatically or with minimal human intervention. They can be programmed to perform a wide range of functions, including manufacturing, inspection, transportation, and service tasks. Robotics technology combines various fields such as mechanical engineering, electrical engineering, and computer science to create advanced machines that can perceive their environment, process information, and execute tasks. The development of robotics has had a significant impact on many industries, improving efficiency, productivity, and safety in fields such as manufacturing, healthcare, and retail. Human-like Robots or Humanoids are still in the prototype phase or other early stages of development, a few have escaped research and development in the last few years, entering the real world as bartenders, concierges, deep-sea divers and as companions for older adults. Some work in warehouses and factories, assisting humans in logistics and manufacturing. And others seem to offer more novelty and awe than anything else, conducting orchestras and greeting guests at conferences. Examples of Humanoid Robots - Some are being used for wars, police, manufacturing, and health services. Others are as simple as Roomba or automatic vacuum that can clean your floors on schedule, take images and video for security services and also map your house for real estate and upgrade purposes. These devices can see (camera), talk (speakers), hear (mics), and multiple sensors to gather data for improvements and to communicate with other devices in their environment. 5. CyberSecurityCybersecurity is the art of protecting networks, devices, and data from unauthorized access or criminal use and the practice of ensuring confidentiality, integrity, and availability of information. It seems that everything relies on computers and the internet now—communication (e.g., email, smartphones, tablets), entertainment (e.g., interactive video games, social media, apps ), transportation (e.g., navigation systems), shopping (e.g., online shopping, credit cards), medicine (e.g., medical equipment, medical records), and the list goes on. How much of your daily life relies on technology? How much of your personal information is stored either on your own computer, smartphone, tablet or on someone else's system? We need to keep these questions in mind and take precautions accordingly. Wars are cyber wars, finance is digital finance, and as our lives and the world continue to migrate to a digital world, cybersecurity becomes more crucial than ever. Some safe recommendations are:

This installment is brought to you by: Notion is the all-in-one workspace that combines notes, docs, project management, and wikis — and makes them all customizable. Over 20 million people and teams around the world use it to collaborate, stay informed, and get more done together. If every person and business can tailor software to their problems, the world will be better at solving its problems. Our mission as a company is to make that a ubiquitous reality.📚 Sources to dive deeper into the above listed technologiesYou’re a free subscriber to Yaro’s Newsletter. For the full experience, become a paying subscriber.

or Send us some ₿ bit-love if you are partial to it: bc1qgq2ld68t0pz4m5z0zprzlvq2gnu2kzaqwhjcax or a One-time donation: Thanks to 👊

Join Yaro on Web3 and its Global Impact in the app Chat with the community, interact with Yaro Celis, and never miss a post. © 2023 Yaro Celis |