Contents:

🐂 The Bulls are definitely out.Two weeks ago we published a newsletter titled “Are the Bulls Out?” wondering if the bear market was finally over. Today we can’t confirm that the bear market is completely over, but the bulls are definitely awake and roaming around. Why ara things changing so rapidly? In the Crypto world:

The Economy:

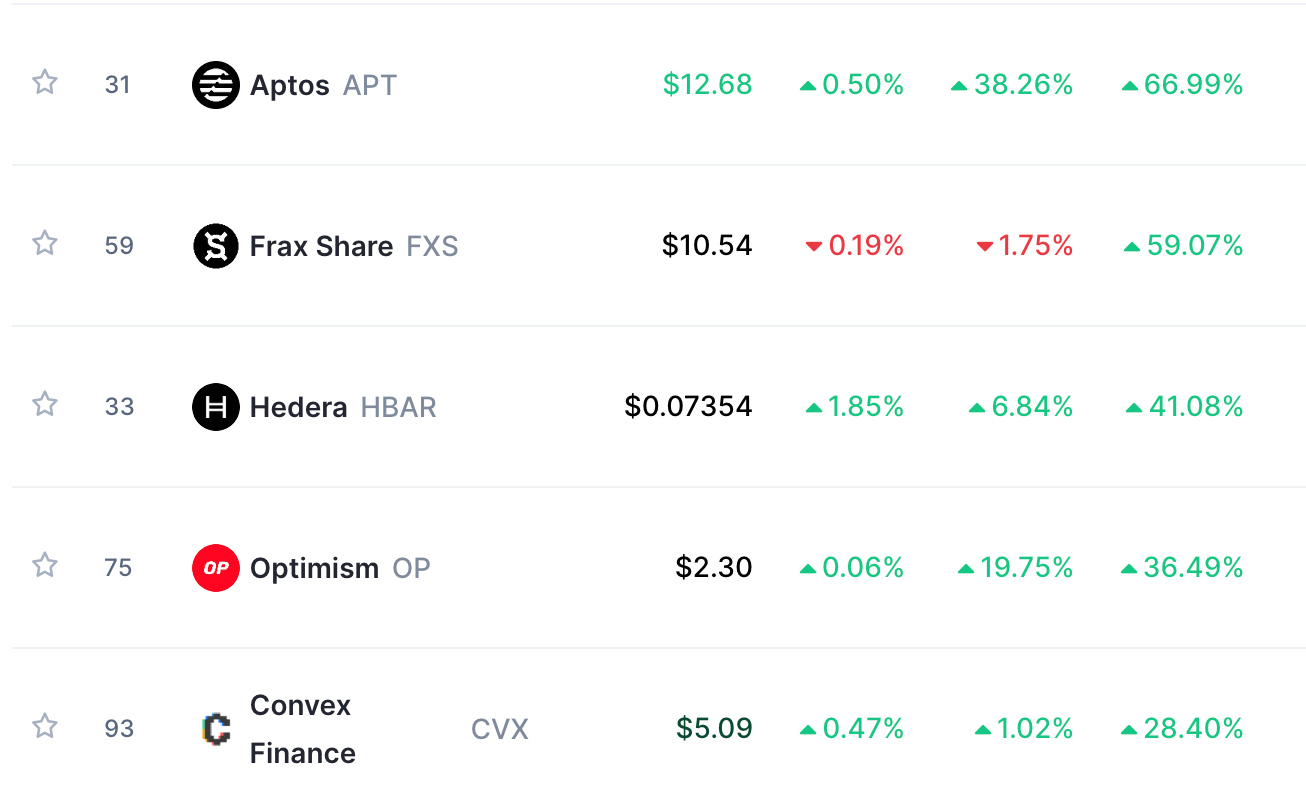

🏦 Will institutions drive the 2023 comeback?A Coinbase-sponsored survey released in Nov. 2022 found that 62% of institutional crypto investors had increased their allocations, while only 12% had decreased them. Additionally, 58% of respondents said they expected to increase their portfolio’s allocation to crypto over the next three years, with nearly half “strongly agreeing” that crypto valuations will increase over the long term. 💰 Coins of the weekAptos is a Layer 1 Proof-of-Stake (PoS) blockchain that employs a novel smart contract programming language called Move, a Rust-based programming language. Aptos’s vision is a blockchain that brings mainstream adoption to web3 and empowers an ecosystem of DApps to solve real-world user problems. The PoS blockchain can achieve a theoretical transaction throughput of over 150,000 transactions per second (tps) through parallel execution. This installment is brought to you by: Notion is the all-in-one workspace that combines notes, docs, project management, and wikis — and makes them all customizable. Over 20 million people and teams around the world use it to collaborate, stay informed, and get more done together. If every person and business can tailor software to their problems, the world will be better at solving its problems. Our mission as a company is to make that a ubiquitous reality.👮 Not everything is well in Crypto Land.Crypto lender Genesis has filed for bankruptcy. The firm has estimated liabilities of $1 billion to $10 billion and assets in the same range, according to the Jan. 19 filing. In a Jan. 19 press release, Genesis said it had been engaged in discussions with its advisors "to its creditors and corporate parent Digital Currency Group (DCG) to evaluate the most effective path to preserve assets and move the business forward.” The firm suspended withdrawals from its platform in November 2022 amid market turbulence caused by the collapse of FTX. The move impacted users of Gemini Earn, a yield-bearing product for users of the Gemini cryptocurrency exchange managed by Genesis. Both Genesis and Gemini are facing charges from the United States Securities and Exchange Commission (SEC) for allegedly offering unregistered securities through the Earn program. Fears are mounting over Genesis' parent company DCG as it may have to sell part of its $500 million venture capital portfolio to try to offset Genesis' liabilities. On Jan. 17, DCG halted dividend payments in a move aimed at "reducing operating expenses and preserving liquidity.” The sale of its crypto media outlet CoinDesk is also reportedly being weighed which could net DCG $200 million. 🌐 This week in the WEB3 and Tech world

You’re a free subscriber to Yaro’s Newsletter. For the full experience, become a paying subscriber.

or Send us some ₿ bit-love if you are partial to it: bc1qgq2ld68t0pz4m5z0zprzlvq2gnu2kzaqwhjcax or a One-time donation: Thanks to 👊

|

Saturday, January 21, 2023

🐂 The Bulls are definitely out

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment