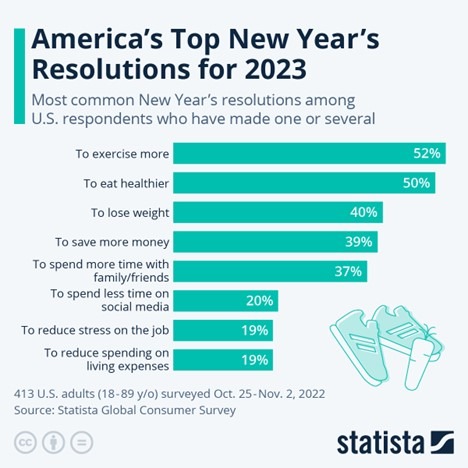

TOGETHER WITH  | Happy new year to you. Among US residents who made one or more 2023 resolutions, can you guess which of the following resolutions came out on top? a. to exercise more, b. to save more money, c. to spend less time on social media. 🌊 Check below for the answer. Here are today's topics: - 2022 Market Recap

- How Much Life Insurance Do You Need?

- What To Expect in 2023

| |

MARKET OUTLOOK 2022 Markets Recap & What's To Come | | | | We know it feels like 2020 just arrived a few months ago, but believe it or not, it's 2023 now. As much of a jump scare as that might be, the past few years have been just as unnerving, with plot twists around every turn. To kick off the year, we'll review what we've been through over the last year, and make an effort to get our wits together about the months to come. 2022 recap - Wrong: The job of market analysts who make their predictions public has proven to be shamelessly wrong. Projections for 2022 have flopped, with Wall Street analysts on pace to overestimate the S&P 500's performance by 40% — the biggest miss since 2008.

- Highs and lows: Instead, what we got was a roller coaster that dipped in and out of a bear market all year. Fear set in early on as inflation raged and international conflict kicked up, we experienced a few relief rallies, and ultimately indexes ended up down across the board as the S&P experienced its 7th worst year on record.

- Predictions galore: Naturally, uncertainty breeds predictions as we instinctively try and figure out what's to come, and 2022 was the epitome of this. Calls for a market bottom, rebound, relief rally, or plunges to the downside were made weekly, with ultimately none of them mattering.

2023 outlook - Uncertainty: Market projections are like throwing darts blindfolded. You might have an idea of where the target is, but no way of knowing when or if someone may move it. 2023 will be no different. We can use the information we have to the best of our ability, but things change every day.

- Consolidation: 2022 was the year we began reigning in the economy after a very lavish couple of years. It's been a painful contraction, but a necessary one too. We're hopeful that 2023 can be a year of "consolidation" in a way, one that gives markets and investors some time to process and collect themselves as the world's financial system mends itself.

- More predictions: 2022 was a notoriously bad year for prognosticators, so although most will still be wrong, they'll likely be closer this year. S&P 500 index projections for 2023 are all over the place, ranging from a loss of -4.6% to a gain of +16.8%, depending on who you ask. What does this tell us? No one knows.

Bringing it together The game of market prophesying is one of precision, and we simply don't have enough information to ever accurately muster more than approximations (which we try our hand at below). While we all hope for a more mundane 2023, the future is forever unknown until it arrives. Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

PROTECTING YOUR INCOME & ASSETS How Much Life Insurance Do You Really Need? | | | | Life insurance is exactly what it sounds like: insurance on your life. It's an insurance plan with a monthly premium promising to pay out a certain amount of money, oftentimes in a lump sum, to your surviving dependents and/or beneficiaries if you were to die. It's a safety net for your loved ones who depend on your income. It's a topic of awkwardness for some and a bit uncomfortable to confront despite its increasing importance as we age. Nevertheless, the age-old question to address when settling on your policy details is this: how much do you really need? What to consider - Firstly, you may not need any... yet. If no one depends on your income, i.e., no children, relatives, or significant other, then there's not much reason for you to be spending monthly on a policy. Life insurance isn't for you, it's for others.

- Some advisors will recommend a policy that accounts for 10-15x your average annual income. For example, if you make $50,000 per year, you should probably be aiming for a policy with a death benefit ranging from $500,000 to $750,000. The higher the number, the higher the premium.

- Cost of insurance increases as you age. The older you are, the more at risk you are of dying. Shocking, right? 40% of US policy holders wish they had purchased their policies at a younger age, not before it was needed, but at a younger age nevertheless.

- And how much you actually need depends on your unique situation. If your only dependent is your spouse and you're both in your 60s, you may not need the full 10-15x benefit. If you're a 29-year-old with 3 children and a spouse, you might qualify as needing more than the 15x range.

Some tips - First, double-check to see if your work offers a group life insurance benefit at no cost to you. Some companies also offer access to purchase supplemental insurance.

- If you're not sure where to start but think you might need some coverage, check out a few providers to compare quotes and features.

- Refresh yourself on the basics:

| | | |

FEATURING FABRIC BY GERBER LIFE Plan Like a Parent | | | | Parenting is hard—getting life insurance shouldn't be. Life insurance is important for your family's future, especially if you have young children. That's why parents choose Fabric by Gerber Life to help them navigate through all the options. They've made learning about and applying for life insurance so easy that you could have coverage in just 10 minutes—all from the comfort of your own home, online or from their mobile app. And they get that trust is important—Fabric by Gerber Life has a higher Trustpilot rating than Ladder, Bestow, and Ethos combined, with 4.8/5 stars and 1,900+ reviews. Fabric's easy digital platform, which also offers support from licensed agents, empowers you to make the right decisions for your family's financial future. Get started today. | | | |

MARKET OUTLOOK What to Expect in 2023 | | | | With everyone on their toes headed into 2023, we're not ones to make any predictions as nothing is certain. Nevertheless, the low success rate of former prophets never deterred us too much to try to be aware of all the possibilities. So, we thought we'd take a peak into 2023 and mentally prepare ourselves for what the year may (or may not) hold. Not predictions, but expected trends - Housing downturn: A combination of running too hot and the Fed's water hose has certainly cooled the white-hot market, and we expect the trickle-down in prices to continue but not crash.

- Mortgage rates level: The rest of the Fed's rate hikes will likely be less severe, and this is already being priced in as fixed rates have been falling.

- Savings stay down: The US savings rate spiked during 2021 as the pandemic stimulus continued, but has fallen to its lowest point in decades recently. As job losses mount, inflation remains, and the contraction continues, most expect the saving doldrums to continue.

- Markets remain ambivalent: Vigilante projections of a big rebound or a continued slouch in the markets are in abundance, but the most likely scenario is a continued meandering about as investors try to make sense of still too many catalysts.

- There will be some form of recession: Whether we're already in one or there's one to come, we'll see symptoms of a recession continue in 2023.

- Inflation may slow at a trickle: Even historic rate hikes haven't been enough to stamp out inflation's blaze by much so far, and the drawdown will likely be a tough fight.

- Crypto undergoes reshaping: After a high-flying 2020 and 2021, 2022 was crypto's worst year of the roaring 20s. This correction continues in 2023 as the industry tries to revamp itself.

- Regulatory crackdowns continue: Between crypto bankruptcies and influencers being booked for securities fraud, it's safe to say changes may finally be underway in the world of finance.

- Innovations in technology will continue to surprise us—things like ChatGPT, immersive virtual experiences, smarter devices, space exploration, and quantum computing—but they won't change our lives in 2023.

- Global uncertainty remains: With a still ongoing conflict abroad between Russia and Ukraine spreading implications across the globe, we wouldn't expect the chaos to recede any time soon.

| | | |

🌊 BY THE WAY | - 🏃🏻♀️ Answer: to exercise more was the top new year's resolution by 52% of respondents; 50% said they wanted to be healthier, and 39% said they wanted to save more money (Statista)

- 🔮 See predictions for 2023 from 1923 newspapers (NPR)

- ⚡ ICYMI. The power of doing nothing (Finny)

- 🚫 Foreigners now banned from buying homes in Canada (BBC)

- 💰 3 key rules change around required withdrawals from US retirement accounts (CNBC)

- ☂️ Finny lesson of the day. With insurance being a theme here today, review some basic terms and key principles:

| | | |

| |

| Finny is on a mission to simply finances & benefits for employees. The Gist is Finny's twice-a-week (Tues & Thurs) newsletter covering personal finance & investing insights and money trends. The content team: Austin Payne, Carla Olson, Chihee Kim. Finny does not offer investment and stock advice. Please support our brand sponsor—Fabric by Gerber Life—as they make rewards on our platform possible. If you're interested in sponsoring The Gist, please reach out to us. And if you have any feedback about this edition or anything else, please email us and we'll be sure to respond. | | | | | | | |

No comments:

Post a Comment